High-level Overview

After last season’s hiatus, I had the pleasure of returning to the major production that is Epic UGM this year. Seeing the amount of new work being done on the campus relative to past years was a visual testament to the amount of continued growth this company is seeing as healthcare continues its digital transformation. Given the tight margins a lot of their clients are currently experiencing, this growth wasn’t always seen with a glowing disposition. Overall, the atmosphere was genuinely positive and optimistic, with most folks I spoke with excited about the prospects for what Epic will be unveiling over the coming months.

There was even more than usual to take in this year as the breadth of their product suite continues to expand. In case anyone wasn’t already aware, this UGM made it clear that Epic wants to own pretty much all of digital health, it’s just a matter of when.

In this post, I’ll be discussing the following updates from Verona:

- Hyperdrive migration: Cloud-based access from anywhere now live

- Builder, Showroom, Cheers, CompassRose: Entering the era of health enterprise platforms

- Cosmos: RWD/RWE and CDS offering

- Generative AI: Microsoft partnership

- Payer platform: Massive growth over a couple years

- Aura: Lab integration, particularly genomics

Non-specific takeaways that I won’t be elaborating on further in this article:

- Data governance is the topic du jour. Epic’s Unsessions are a great place for us to conduct our research onsite. We get to hear from end users about their successes, emerging best practices, biggest frustrations, and pressing problems. The Unsession on Data Governance is the only one that I walked out of because it was too full.

- People are already over the AI hype. But they are still attending the sessions. The AI sessions I attended were all still very busy, but attendees want to see results and understand how to properly adopt what’s available that’s been deemed safe. They really don’t want to see another suspect AI use case pushed in front of them.

- In-basket hell is real. Providers need help. Automation will provide relief, but still requires a human-in-the-loop in most cases, so while those tools are being implemented and configured, the basket continues to fill.

- Specialties are hot, hot, hot. Epic is getting into specialty-specific offerings. athenahealth is leaning into this area more. NextGen is getting acquired this week; it seems like right now, everyone is looking at specialties as a key growth area for health IT.

- BPAs (BestPractice Alerts) can either be super helpful or absolutely awful. This one combines governance and automation interests. Some leaders find the BPA tools to be a massive productivity booster, while others have seen an overwhelming proliferation of them having the opposite effect. Biggest takeaway here is that if you intend to implement the BPA functionality, have a clearly defined, well-governed process for developing them.

Recognition

Before jumping into the deeper coverage, a few shoutouts:

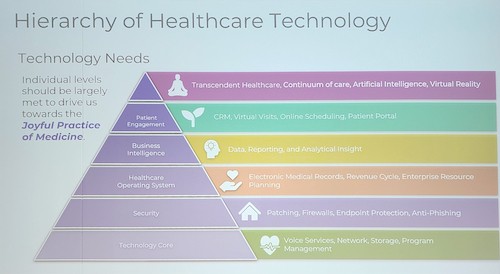

- This “Hierarchy of Healthcare Technology Needs,” shared by Daniel Barchi, CIO at CommonSpirit, during his illuminating presentation:

- The petting zoo is a personal highlight every time. Fun fact: I wanted to be a veterinarian when I was a kid, until our vet told me it was all the work of medical school with none of the perks like good pay.

- The Epic staff! They do such a great job encouraging everyone to have a good time and really get into their characters that go with the theme. You can tell that most of them are legitimately having fun. It’s also nice to see how many junior employees are attending sessions and taking notes, actively learning from users.

- The massive LED wall in the main auditorium, which my VJ wife would love to play on. As a bit of a nerd for screens, this monstrosity always makes me happy.

Got our Heads in the Cloud(s)

After a few years and an intense resource allocation, Epic is ready to replace their Citrix-based Hyperspace interface with their own browser-based Hyperdrive. This has been a major migration that goes along with the overall shift to cloud infrastructure being seen across all industries in the past few years. All users will be expected to make the shift to Hyperdrive by the November 2023 release later this year.

While this isn’t a particularly exciting update, it is one that matters. Many people I spoke with about this were looking forward to the convenience factor of accessing their system from anywhere, combined with the cost savings opportunity of cutting out the Citrix middleware – especially with their prices jumping substantially this year. [Sidenote: It might be time to drop Citrix stock and put it into Microsoft (I’m not a financial advisor; do your own research).]

The other reason that this is an important milestone relates to the amount of technical resources that are freeing up with the completion of the migration. Apparently, this was a massive lift across the organization, and now that it is moving into more standard development and maintenance, Epic developers will be reallocated to building many of the new features that are rolling out in the coming months.

Making Strides Towards a True Platform

Builder tools and the Health Grid

One of the single biggest critiques of EHRs is that at their core, they are too static. Their very reason for existence is to be a system of record for billing purposes. Obviously, their charter has expanded since the early days, but the foundational characteristics of EHRs cannot be ignored as we look at where they have fallen short of market expectations as a category.

Still widely seen as a relatively closed system compared to much of the market, recent regulations and louder customer demands are driving them to adopt a more open position so the suite of tools – and infrastructure with their expanding cloud service and Nebula – can be implemented as more of a proper platform. One can see glimpses of this with many of the new tools that are coming down the pike, such as the low-code development environment for MyChart and CareCompanion (referred to as Builder in both cases), making it easier to customize these two critical engagement tools.

Epic also appears to be taking a more wholistic view on their place in the market, which is reflected in this “Health Grid” slide here. Granted, most of what they present in this slide are solutions they are building in-house, but based on some of the other presentations throughout the week, and Judy’s repetition of the Health Grid terminology in her presentation, this model is one of the key ways they are going to conceptualize their future buy/partner decisions.

Epic also appears to be taking a more wholistic view on their place in the market, which is reflected in this “Health Grid” slide here. Granted, most of what they present in this slide are solutions they are building in-house, but based on some of the other presentations throughout the week, and Judy’s repetition of the Health Grid terminology in her presentation, this model is one of the key ways they are going to conceptualize their future buy/partner decisions.

App Store Chaos Ending?

In December 2022, Epic made the unexpected announcement that they were going to close down the App Orchard “temporarily” and relaunch it in 2023. In its place, they propped up the “Connection Hub”, which was meant to be a substitute until they could relaunch a new model for their app store.

This quote by Nate Bubb, technical services lead at Epic, from the Fierce article shared above, is basically the same line used onsite to explain the changes:

“I think the challenge has been on CIOs and CEOs that are trying to do best for their health system. And they say, ‘I just see a world of noise out there of different apps and who’s innovating, who’s not.’ And I think the brass tacks question that usually is helpful to give more signal to our customers is ‘Has this group connected their product to another Epic system?’ And that’s really what the Connection Hub serves for.”

Well, the messaging is changing again. The Connection Hub is one component of what is now dubbed the “Showroom.” The Showroom is much more than just an app store though, as you can see in the image below:

The Vendor Connections is where most of the Epic attention was focused, so I wouldn’t be surprised to see the Connection Hub being quietly sunset in a year or two. I honestly had no recollection it was even mentioned onsite until I was reviewing my photos and saw this slide.

As of publication, there are a total of 6 organizations that have partnered with Epic to be part of their Vendor Connections in some capacity:

Everything was still pretty wishy-washy with the definitions of these different programs, but it’s clear that there is a new strategy emerging around how the company will be managing a third-party ecosystem. Judy, and then other staff during breakouts, did explain that a key differentiator for this ecosystem concept is that any solution in this Connections category will be thoroughly vetted with a proven easy path to integrate in users’ Epic environments before going live in the Showroom.

Omnichannel Engagement

Relationship Management

Epic has often been faulted for the lack of innovation around patient engagement offerings. Being an historically close-walled system, it was also difficult for users to layer a third-party solution on top of the EHR data, preventing many from enabling truly data-driven, personalized engagement strategies they would have liked to utilize for patient activation.

To this end, last year Epic introduced Cheers, their version of a CRM suite. Based on everything I heard from the early users, it’s still pretty rough around the edges and leaves much to be desired, but the clients I spoke with are thrilled about the possibilities coming at them as development continues and more capabilities are added. This includes the ability to configure patient-facing chatbot(s), a new text-messaging service they’re calling Hello World, and VOIP services for secure phone calls directly from within the system.

There’s still a lot to be desired here for Cheers to be up to par with other full CRM suites, but as we wrote a couple years ago, a healthcare-specific relationship management platform can enable some very different interactions than more run-of-the-mill CRMs. They’ve been very slow to do much here, as J2 called out last year, so I’m curious to see how Epic delivers going forward, now that they claim to be putting greater resources into building this out.

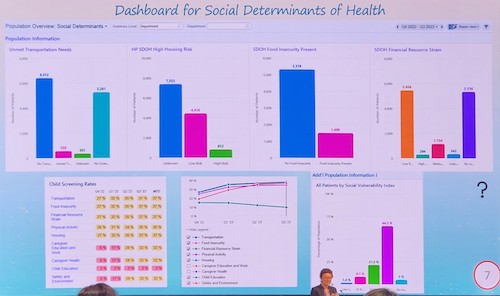

SDoH and Health Equity

One of the biggest frustrations that we’ve been hearing since the mandate came down to start tracking social needs is that healthcare providers feel powerless to do anything to help. So they’ve identified a need during a patient interview – now what?

Since we started covering the new IT solutions entering the market to address SDoH, the biggest issue has always been how to integrate a referral network for community resources into the care workflow. As much attention as it has been getting over the last few years, this only became a proper business consideration in the past year when CMS directed hospitals to start screening for SDoH needs as part of their performance reporting requirements, impacting payouts starting in 2024.

Accordingly, Compass Rose, Epic’s care coordination/PHM tool, doesn’t appear to have progressed too much since its introduction a few years back. That said, I sat in on a few presentations that showed how users are finding ways to actually bring this into their practice. Frankly, change management is the single biggest complication around adopting an SDoH strategy, simply because this goes well beyond the purview of traditional responsibilities for a care provider. I wouldn’t expect too much to change here until there is more clarity from the regulators around what will be expected from health systems in the long term.

Engagement Analytics

Analytics around engagement and satisfaction metrics are still very much lacking according to many users. In an Unsession on engagement, users in the room were pretty frustrated by the lack of progress around effectively integrating satisfaction scores, HEDIS measures, and more granular engagement statistics into the system. It was unclear how soon this will change, but the recent partnership announcement with Press-Ganey looks like a step in that direction.

Getting Real with Data: Cosmos Grows Up

We’ve been covering Epic’s real-world data research and CDS tool since it was first introduced in 2018. We can finally say they have achieved a critical mass with records for 210 million unique patients across 4 billion visits. I’ve been subscribed to Epic Research Network updates for a few years now, and as a former bench scientist, it’s pretty cool to see the proliferation of studies and use cases for the dataset.

Epic Research Network updates for a few years now, and as a former bench scientist, it’s pretty cool to see the proliferation of studies and use cases for the dataset.

Big announcements re: Cosmos this year included the first EHR-EHR transfer of genomic data, the start of clinical trial recruitment for rare conditions (potentially through the Invitae partnership?), and adding the ability to compare like to like patients for determining the best course of treatment. This is something they’ve been promising for years as it was always one of the key goals that Cosmos be a CDS tool to help treat complex patients.

However, it’s not all candy and rainbows as they would like you to believe. In one of the sessions I caught, the presenters shared some of the limitations of the data, most notably that it is still struggling to map actual dates in records to a truly longitudinal view of the patients in the system. The example they cited was a quick query they ran to see how the prevalence of a certain diagnosis has changed over time. Over 20 years, the result showed there were ~900k cases diagnosed. Over the course of a 24-hour window, the result showed ~600k cases. Obviously that’s not right; this shows there are still some issues with reconciling data (especially around dates) and mapping those properly. Given the 100-member Cosmos R&D team, hopefully these kinds of bugs get fixed soon and society can really start getting the full value of these data sets.

That said, so long as researchers are being careful, aware, and paying attention to the limitations of the tool today, this is an incredibly powerful dataset – and only getting better.

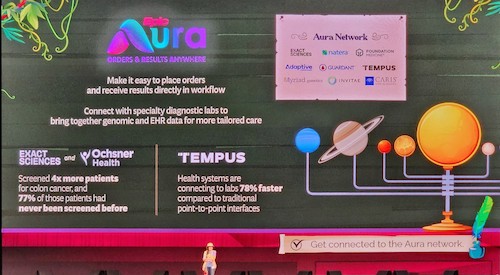

Aura and the Cosnome

They also introduced the Cosnome this year, the space within Cosmos dedicated to handling genomic data. This is being powered by Aura, their lab integration tool introduced last year. Serendipitously, I happened to sit next to a geneticist from Denmark during the executive session, and she was thrilled about this part of the session.

You can see in the image that Epic has partnered with most of the bigger names in commercial clinical genomics to integrate this data – mostly framed around cancer diagnostics and pharmacogenomics testing: Exact Sciences, Natera, Foundation Medicine, Adaptive Biotechnologies, Guardant, Tempus, Myriad Genetics, Invitae, and Caris Life Sciences (we’ll be covering Tempus and Invitae in our forthcoming RWD Buyers’ Guide report). This is a rapidly evolving area in general, so I expect there to be some rapid iterations on functionality here to meet different use cases in the year to come. To date, they have sent 1M orders on Aura.

I also attended a genetics Unsession to learn more about how users were actually implementing this into practice. As noted elsewhere, my first jobs out of undergrad were working in genetics labs at MGH and Novartis, so I will always be curious about new developments on this side of healthcare. The main takeaway is that this is still very new, but the user base is really looking forward to having this be more seamlessly integrated into their systems, especially hospitals with oncology practices. The research side of the user base were also all pretty excited about what this could mean for their work going forward.

That said, there are of course still kinks in the system. The main issue seems to remain the reliance on PDFs for sending results and recommendations, as in so many other areas. There’s currently no OCR capability in Aura to pull out and map lab recommendations or other interpretive notes directly to a patient record – and even if the OCR were there, the mapping doesn’t currently exist anyway. I expect this will be rectified as Aura receives more developer attention, it’s just a matter of how long it will take.

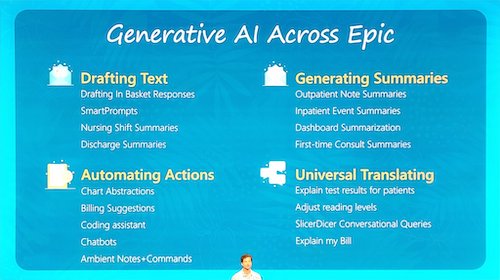

Generative AI

As with any tech event this year, the generative AI discussions were frequent in Verona this year. Back in April, shortly after the big chatGPT buzz across tech writ-large, Epic was already showing off their own GPT4 tool at HIMSS. It’s quite clear their enthusiasm hasn’t slowed by any means, as from that one use case in April, they are now enabling seventeen different use cases across the product suite only 5-6 months later. Staff was very clear that this is still intended to be a human-in-the-loop process, as it should be, but the productivity boost/time savings from having a computerized assistant to help with these various tasks is going to make a lot of users very happy.

As with any tech event this year, the generative AI discussions were frequent in Verona this year. Back in April, shortly after the big chatGPT buzz across tech writ-large, Epic was already showing off their own GPT4 tool at HIMSS. It’s quite clear their enthusiasm hasn’t slowed by any means, as from that one use case in April, they are now enabling seventeen different use cases across the product suite only 5-6 months later. Staff was very clear that this is still intended to be a human-in-the-loop process, as it should be, but the productivity boost/time savings from having a computerized assistant to help with these various tasks is going to make a lot of users very happy.

The big surprise guest for the Executive Session this year was none other than Microsoft CEO Satya Nadella, who sat with Epic SVP Sumit Rana to talk about the future of tech, healthcare, the Epic-Microsoft partnership, and of course, AI. Here’s what Mr. Nadella had to say about the cyber threat in the age of LLMs and generative AI:

A couple weeks ago, @satyanadella took the stage with @sumitrana to discuss the Epic-@Microsoft partnership and future of AI more generally. Here’s what the MSFT CEO had to say about #cybersecurity considerations as we enter the era of #GenerativeAI pic.twitter.com/liO5p9F8gp

— John Moore III (@j3moore) September 7, 2023

The Unsessions on AI were fairly redundant with what we’ve been hearing in all quarters; people are excited about the prospects, but nervous about the technology itself still. Beyond the reliability of the predictions these new tools are delivering, there are still a lot of liability questions to be worked out, not to mention the well-discussed data quality issues. It will still be some time before most clinicians are ready to use this kind of tool for actual care decisions, but they are certainly proving themselves useful productivity assets in the meantime. [Stay tuned for an upcoming *free* eBook we’ll be releasing on AI in healthcare].

So far Epic is moving fast, but in the areas of least risk to patient outcomes. It’s a smart move to lean into creating productivity boosters right now that can develop trust and reliability in the AI offerings. Ride the hype, deliver on the promise in a low-risk use case, and build up from there. Very curious to see how this ends up being applied in the Cosmos environment, and just what it will show about the quality of the data in there.

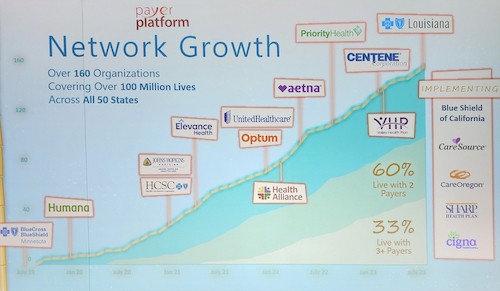

Payer Platform

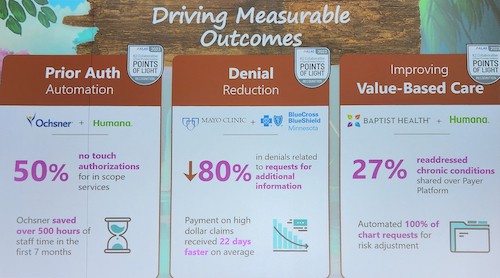

Elena already spoke to this in her post last week, but it warrants repeating. The Payer Platform is still slowly moving towards the goal of having true bi-way communication between providers and payers. The adoption has picked up a lot from when they first announced their initial partnerships with BCBS and Humana in 2019: We’ve been waiting on this for quite some time. Chilmark first began writing about the concept of Payer-Provider Convergence years ago, even hosting a conference on the topic in 2017. It looks like Epic agrees that this is the future of patient-centered care, and are really looking to make this a big area of differentiation going forward – something they are pretty uniquely qualified to provide, given their scale; only a couple other orgs could really attempt something of this magnitude. Now that the data is actually starting to flow, Epic is able to demonstrate early results, such as these:

We’ve been waiting on this for quite some time. Chilmark first began writing about the concept of Payer-Provider Convergence years ago, even hosting a conference on the topic in 2017. It looks like Epic agrees that this is the future of patient-centered care, and are really looking to make this a big area of differentiation going forward – something they are pretty uniquely qualified to provide, given their scale; only a couple other orgs could really attempt something of this magnitude. Now that the data is actually starting to flow, Epic is able to demonstrate early results, such as these:

This is probably one of the most exciting things I saw demo’d the whole week we were there. Epic’s still got a lot of work to do, especially around activating payers to fully leverage this new tool they aren’t used to working with, but the roadmap they showed for how this could improve the patient and the provider experiences is pretty compelling. The vision is spot on with what we’ve been waiting for, so we’ll just have to wait and see how much things have progressed by next year.

Final Thoughts

I hope you have enjoyed my epic recap of Epic UGM2023. There are plenty more topics I could go into, or I could delve deeper into the ones shared here, so I’m happy to answer any questions in the comments or on social media. This year UGM showed an Epic that’s really taking the next iteration of what an EHR could be to heart. After years of relatively bland updates to the core systems, the vision I’m now seeing for the full suite looks to be something much more robust, connected, and productive for all stakeholders. We’ll just have to wait to see what next year has in store for us.

0 Comments