On August 25th, as I was undergoing a procedure at a local hospital, I tuned in to Epic’s virtual UGM keynote session to hear the latest and greatest from one of the leading health IT vendors in the market. While very informative, the event was stale. With plenty of time to prepare, was truly hoping for something novel, creative for this virtual event. If this is going to be the future state of all user conferences this fall – it is going to be challenging for this analyst to stay awake.

That is not to say I did not learn a thing or two during this event. Quite the contrary.

Key Takeaways:

COVID is driving most of their development work in 2020. These advances will provide significant value to their customers beyond the current crisis, e.g. patient flow in acute care setting.

Doubling down on patient engagement on multiple levels, from validating consumer app data access to price transparency, to payer/patient plan rates and co-pays to self-monitoring and scheduling->check-in->directions to exam room, etc.

Arguably the only EHR company with a comprehensive, publicly stated plan for the payer market.

Continues to gain market share, both in acute and ambulatory, at expense of competitors. Merger and acquisition activity across provider landscape is a leading factor.

Cosmos, the shared research dataset across the Epic user-base, now has nearly 60M patient records – impressive growth in a few short years – with Epic demonstrating a clear and compelling COVID use case.

Virtual Care Here to Stay

It really should be no surprise that, along with every other EHR vendor in the market, Epic has spent most of 2020 developing resources and solutions to help their customers address the COVID19 pandemic. No surprise that telehealth (more than 10 million visits so far via Epic in 2020) and more broadly, virtual care were at the top of the list. The new, virtual care models they have built to assist COVID positive patients with care-at-home that include remote patient monitoring, will be a gateway to future remote care delivery models.

Clearly, Epic sees virtual care as here to stay, which I and Chilmark Research as a whole, are in full agreement with. COVID has forced the issue on providers. However, consumerism will continue to drive this trend forward as patients increasingly demand their providers to meet them where they are, and not the other way around.

Pushing Forward on Patient Engagement

Along a similar vein, Epic made a number of announcements regarding new features for its patient portal, MyChart. Unlike its main competitors Cerner and Allscripts, who have taken a more “open” approach to their patient portals, Epic continues to double down on building out the functionality themselves. This approach provides more integrated functionality with the core Epic platform. The trade-off though is lack of access to third party, best-of-breed solutions and the challenges of aggregating one’s records from other, competing EHR solutions – you’ll need a third party app for that.

Regardless, Epic’s MyChart advances are noteworthy. First-off, a leading concern Epic had with the new interop regs was nefarious consumer apps having access to patient data when a patient would invoke such apps. MyChart now has a feature that will tell a consumer just how much of their record a given app seeks access to and whether or not they should proceed with caution.

As per the Cares Act and price transparency rules, MyChart will also have the capability to show a patient just how much a given procedure will cost. Working with payers, Epic also plans to provide benefit plan information (out-of-pocket costs) to the patient as well.

Virtually all EHR-centric patient portals today have self-scheduling of appointments capability. What Epic is now introducing (COVID prompted) is an ability to go beyond just scheduling to online check-in (yes, most portals have that today), to directions to the physical exam room (no checking in at front desk), to discharge notes. A nearly complete closed loop process with the only human interaction being that with your clinician – nice.

Beyond MyChart, however, the company is developing condition specific applications that will guide a patient along their health journey. The one they demoed was for pregnancy. The app guided a patient from conception, to birth, to pediatrics including educational materials (e.g. nutrition), important milestones, etc. As a patient with a chronic condition myself, such tools will be invaluable in assisting one on their health journey. I just wish the industry would move faster on this front to truly enable and support self-care for a multitude of conditions.

Payers the Next Market for Epic?

Despite continuing to rack up wins against their competitors in the provider market, that market in the U.S. is saturated. The payer market is anything but, especially when it comes to payers’ desire to have access to clinical data and forging closer ties with health systems – something we refer to as Convergence.

Epic is the rare EHR vendor with a comprehensive plan for the payer market. Today, they are working with payers Humana, BCBS of MN and HCSC to further build-out functionality well beyond what they have done for provider health plans via Tapestry.

Their “Payer Platform Network” will do a lot of things for different kinds of payers as well as for its provider customers. Beyond sharing clinical data to minimize disruptive chart pulls, Epic will pull in payer data on patient utilization (out-of-network care), gaps in care and promote in-network referrals based on a patient’s benefit plan. Epic will support the three major APIs required of CMS-regulated health plans.

Epic has also laid the groundwork for making prior authorization workflow an integral part Hyperspace. The big question here is how will Epic actually scale this capability beyond the payers it is currently working with as each payer approaches prior auth differently.

Clearly, Epic sees the payer market, beyond provider-sponsored health plans, as a green field opportunity and intends to fully capitalize on it. Will they have the same success as what they have seen in the provider market? Only time will tell, but they are off to a very good start.

Analytics: Steady Progress, Cosmos – Wow!

While artificial intelligence (AI) has been overly hyped for a few years now, that does not mean there is no value. What we are finding in today’s market is that AI, in and of itself, is rare. Rather, AI is being embedded into any number of workflows, transparently working behind the scenes to support clinicians and administrators.

In Epic’s case, they have built a number of AI algorithms. During UGM, Epic claimed that their algorithms have been run over 17 billion times. A popular one in these pandemic times is their COVID deterioration index that alerts providers of patients that are on verge of deteriorating quickly. Epic will be offering some of these AI models through its App Orchard in the future.

With Cogito, Epic’s analytics platform, , the company added several patient flow reporting applications that look broadly at how the changes to demand and capacity ripple across different parts of a provider operation. On the usability front, in the near future Epic will have a Cogito “recommendation engine” providing a user recommendations of various reporting tools and their popularity with other Cogito users based on a user’s past choice of reports and dashboards.

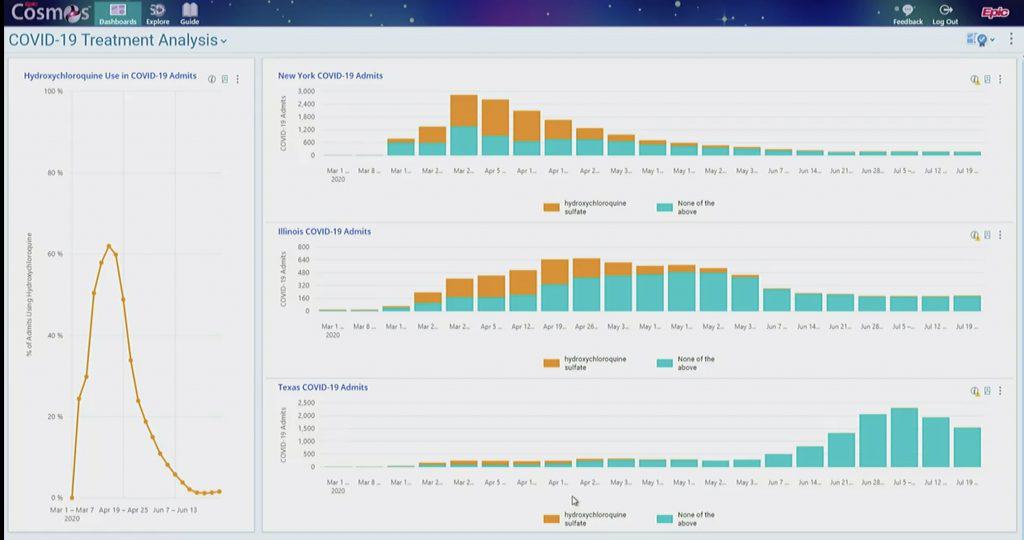

A couple of years back we reported from a previous UGM Epic’s launch of Cosmos – their vision for a shared data resource. At the time of that launch only one health systems was moving data into Cosmos and a handful of others had committed to it. Fast forward to 2020 and Epic now has close to 60 million clinical patient records in Cosmos! Important to note these are clinical records, not claims. Clinical datasets provide a far richer dataset for research purposes.

Epic’s stunning use case demonstration of Cosmos at UGM2020 was the use hydroxychloroquine for COVID-19 admits over time from three geographically distant states in the U.S. One can only imagine what such a shared database may offer in the future for public health purposes, which as the pandemic has so sorely pointed out, is in complete disarray.

To see more of what researchers are doing with Cosmos, Epic established a separate website – the Epic Health Research Network (EHRN) to allow providers to publish their research findings that leverage Cosmos. While the research published on the site is not peer reviewed, it does appear valuable and worth a look.

Healthy Planet, Value-based Care – What’s That?

Chilmark had a number of analysts listening in on the UGM presentation and not a single one of us could recall Epic mentioning their population health platform (PHM), Healthy Planet. Nor could any of us recall any mention of value-based care (VBC).

Sure there were side references to care management/care coordination, social determinants of health, analytics, interoperability – all core elements of any PHM solution, but no actual mention of PHM, VBC or more importantly Healthy Planet. It is as if these words are now verboten, struck from the lexicon of healthcare and Epic today in these pandemic times. I am not sure if this was intentional or not but I do find it a curious artifact of Epic’s 2020 UGM.

Wrap-up

While Epic gets a lot of criticism in the market for some of its practices – some deserved, most not – one cannot argue with Epic’s success and continuing efforts to stay one step ahead of most others, especially amongst its EHR brethren.

I have often been quite critical of this company and some of its actions, but I am impressed by the continuing advances they have made to improve the care delivery process, which pushes all vendors to up their game. And is that not a good thing for this, at times, incredibly staid, conservative market with countless entrenched interests? Give credit where credit is due. During this time of the running of the 2020 Tour de France, I say Chapeau Epic!

0 Comments