While we try to stick to IT-related topics, in healthcare one cannot divorce policy from technology adoption as federal policy has been and will likely continue to be one of the key macro-economic forcing factors to IT adoption in the healthcare sector.

Certainly, the ACA (Obamacare) will see an overhaul. It is unlikely that there will be a full-blown repeal of ACA as many of the programs within ACA have become part of the fabric of healthcare and would be too difficult to unravel (e.g. MACRA). But make no mistake; significant changes will be phased in over the next few years. It is also important to look beyond just the changes that will be made to ACA as the healthcare sector touches just about every sector of the economy.

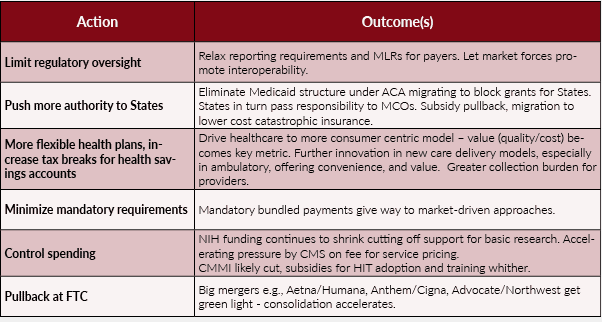

During the election campaign, Trump rose to President-elect without divulging any real details as to how he would actually implement his proposals. One must look beyond Trump to the core Republican value of letting market forces lead the way with little government oversight to determine where we might be heading. The Chilmark Research team met collectively to discuss what are the implications of this new Republican leadership team in Washington on the healthcare sector. The Table below is a summation of those discussions of likely policy changes.

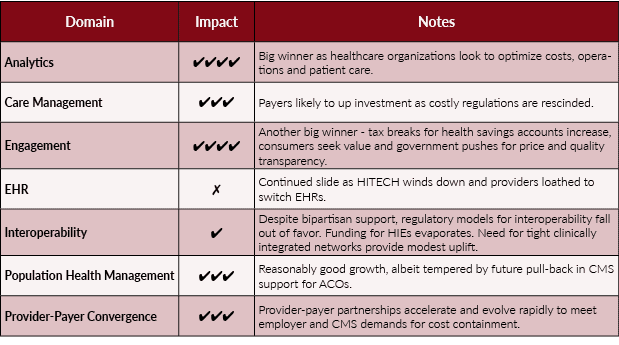

As mention previously, in healthcare, IT adoption has been tightly linked to federal policies. That will not change going forward. Looking ahead, Table 2 provides a brief analysis of how the healthcare IT market will fare under this new administration.

Looking Ahead Regardless of who ultimately took office in the 2016 election cycle, the overarching impact to IT adoption is modest. HCOs will still need to continue to increase their investments in analytics to reign in costs and improve quality. The move to a more consumer driven market will also herald yet another round of investments in new care delivery models and software to support. However, mandated models and regulatory approaches to solving some of the ills in healthcare will fall to the wayside. For example, data exchange/interoperability will pull back from being a social/medical need that is mandated to being a business/market need that is economically driven. Our advice to HCOs, do not wait for the dust to settle in Washington. The need to continue to improve costs and quality metrics will continue unabated requiring a long-term investment strategy in IT to facilitate cross enterprise care delivery.

0 Comments