On August 5th, Teladoc (TDOC) announced that it would be acquiring fellow virtual care vendor Livongo (LVGO). And with that announcement the race to see who would become the virtual care platform vendor the market has been seeking may already be over. While some may balk at the premium paid for LVGO, an eye-popping $18.5 billion, in hindsight this will be seen as a brilliant move. Together, TDOC and LVGO have taken the pole position in virtual care – no one else comes close to what this combination offers the market – a true, virtual care platform.

Key Takeaways

- Teladoc and Livongo merger represents the first in a likely long-series of pending M&A and partnership activities between telehealth vendors and virtual care vendors over the next 24-36 months.

- Livongo represents a continuation of Teladoc’s aggressive M&A strategy and marks the first large-scale acquisition outside of telehealth-related solutions.

- Merger presents an opportunity for a significant amount of cross- and upselling both domestically and internationally.

- The acquisition is clear recognition that video telehealth, by itself, is insufficient for long-term patient health.

Background

The virtual care market has been on a tear since the COVID19 pandemic took hold in the U.S. and care delivery became much more virtual. Regulations regarding telehealth have been relaxed, some permanently. Payers, including CMS are supporting reimbursement, often at parity with in-person visits, have also contributed to dramatic growth. Both TDOC and LVGO, relatively new public companies, have seen dramatic increases in their valuations as investors flocked to digital health. And there was good reason to invest in these two companies. They are well-run, company executives have deep healthcare expertise and their recent sales growth has been impressive.

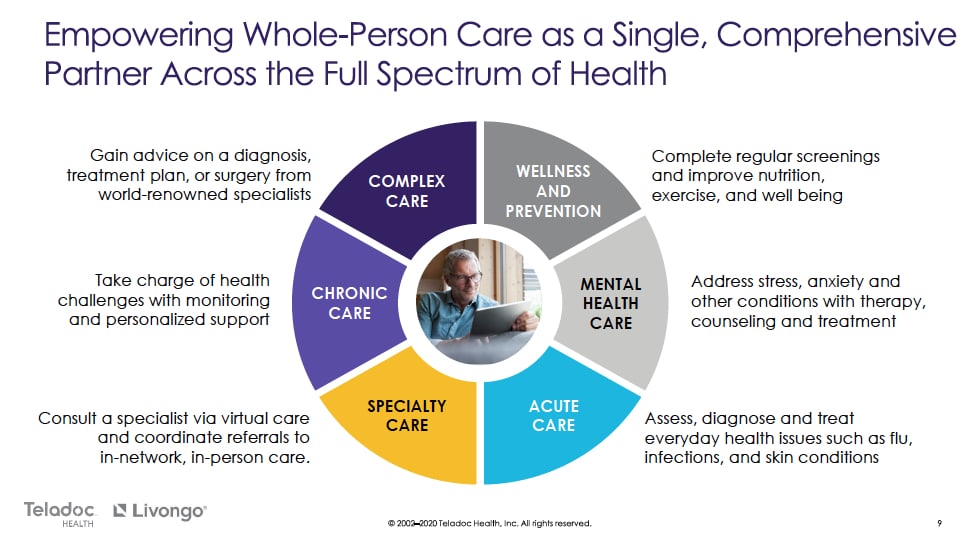

As we wrote in May, virtual care was a big beneficiary of the pandemic. But we also saw clouds on the horizon. Telehealth on its own is insufficient and we’re already seeing significant drops in telehealth visits since their highs earlier this year. The chronic care management space is littered with small, niche solutions – little if anything at scale. Remote patient monitoring (RPM) and the migration of the hospital to the home is anything but well-knitted together. What is, or at least was, lacking in the market was a clear virtual care platform that pulls all these desperate pieces together. This acquisition does just that, creates a virtual care platform addressing episodic, urgent and chronic care needs. Does it have everything, of course not but what it does have – telehealth, diabetes management, behavioral health – is a good start towards covering many an employer or payer need and no doubt there will be future acquisitions to continue to build-out this platform.

The merger combines TDOC’s comprehensive telehealth platform (i.e., general medical, behavioral, expert second opinion, international reach, etc.) with LVGO’s leading virtual care capabilities focusing on managing chronic conditions especially diabetes.

Acquisition Rationale

There are several reasons why TDOC made this acquisition and why they did it now versus say six months hence. These include:

Stock price may have reached its peak. Both TDOC and LVGO have been riding the COVID19 wave since late February seeing dramatic increases in their valuations. However, telehealth visits have drifted down significantly from their peak. As this deal was for the most part a stock transaction, TDOC likely wanted to leverage their current valuation/buying power to acquire LVGO and keep their growth momentum going.

Market is seeking “one solution” to address a multitude of needs. As virtual care came to the forefront in 2020, customers pushed the merger desiring a wider array of virtual care services within one platform. The companies’ reported that the process was strategic and not competitive as their offerings are complimentary. Both companies had been looking for capabilities to enhance their existing product offerings (LVGO was looking at telehealth), and ultimately felt that the opportunity to create a “category defining company” was too strong to pass up.

Video telehealth is no longer enough for a virtual care solution. Teladoc has been focused exclusively on the provision of video telehealth. Their on-demand telehealth offering focuses primarily on non-emergency, acute needs, similar to urgent care or retail clinic. With LVGO, TDOC can now offer not just solutions for episodic care, but chronic care as well – a stronger value proposition for payers and employers.

Livongo’s positioning and growth in chronic disease management. Livongo has the largest number of diabetic members on their platform (~323k as of 3/31/20) among digital health vendors focusing on diabetes management coupled with continuing aggressive growth and strong retention rates. Additionally, LVGO has been building out its own portfolio over the past 18 months through acquisitions and internal development. Livongo now offers solutions in hypertension, pre-diabetes and behavioral health, which are typically bundled with a new or existing diabetes program.

Livongo’s highly, predictable revenue stream. LVGO generates around 90-95% of its revenue from monthly subscription fees. Unlike other benefit plan solutions where a company might pay for its entire employee population to have access, employers and other LVGO clients pay only for the subsets of their populations that are at-risk and who actually use the solution. LVGO currently experiences a 35% average enrollment rate in its diabetes management solution that can go as high as 50% among its best clients for eligible populations. Those are impressive enrollment numbers.

Bolster international expansion efforts. Teladoc has been expanding outside of the US since acquiring Advanced Medical in 2018. Livongo has not yet focused outside of the United States but this acquisition presents an opportunity for LVGO to aggressively expand internationally through the TDOC channel.

Future Outlook

COVID-19 accelerated telehealth adoption by a decade in a few short months. Several factors converged to facilitate massive spikes in adoption:

- Broad-based, stay-at-home orders and consumer fears of contracting COVID19 at a doctor’s office or hospital dramatically accelerated the use of telehealth.

- Providers, facing sharp declines in patient volumes, were forced to adopt as well.

- Regulators, and by extension, payers, quickly eased restrictions and financial impediments for both patients and providers to utilize telehealth services during the pandemic.

The unanswered questions that the industry must now must address are the durability, breadth (aka use cases), efficacy and allocation of expanding virtual care services.

The pandemic provides consumers an opportunity to use telehealth services, which from personal experience is quite convenient. Going forward, post-pandemic, will consumers demand more such services, seek them out, even if their own provider does not provide such? This one of the biggest questions looming. No doubt, there has certainly been a seismic shift, but telehealth sustainability post-pandemic remains a question particularly in light of competing services (retail clinics, urgent care, etc.) and offerings directly from large health systems.

There is also the question of value for such services that the new TDOC-LVGO combination will provide. While there is anecdotal evidence that these solutions are providing value (quality/cost), it is far from conclusive. We are still very early into the transition to virtual care. Long-term, I believe it will prove out that these solutions address a critical need in the market and do deliver value, but that is more conjecture on my part.

The exceedingly rapid transition to virtual care has caught many flat-footed, primary among them, incumbent vendors to providers. This acquisition will be a wake-up call for many to reassess their current strategy and offerings. Today, I cannot point to a single, incumbent vendor in the healthcare IT market that has a compelling virtual care platform offering for a mid-to large size health system. Expect such vendors as J&J, Medtronic, Philips, Epic, Cerner, Optum and others to make some aggressive moves in next 12-24 months.

CARES Act money targeted at subsidizing the purchase of virtual care solutions and their supporting device and infrastructure needs will provide a boost to purchasing such solutions by providers but will purchasing continue after the subsidies are gone? Will providers continue to be reimbursed at parity to in-person visits as they are today for telehealth visits? These issues of cost and on-going reimbursement will be critical factors in how quickly providers scale-up their own virtual care programs.

Appointment and reimbursement questions pose the greatest risk to TDOC, but regulatory issues are potentially the greatest threat to LVGO. The FDA is still in the process of defining their regulatory scope over Software as a Medical Device, an area that includes AI/ML clinical recommendation algorithms. In their latest, draft guidance, any use of software algorithms that are intended for patient consumption, or ‘drive’ rather than ‘inform’ a clinician would fall under FDA oversight. Requiring FDA approval for the ‘health nudges’ and Applied Health Signals that form a core part of the LVGO value offering could present a serious obstacle.

Final Thought

Prompted by the pandemic, the front and back doors to care are changing rapidly fostering the growth of new care delivery models. But with these new care venues, what happens to the longitudinal patient record (LPR)? Who becomes responsible for maintaining such, especially for a high-cost, multi-chronic patient that has a local PCP, sees several specialists, uses LVGO tools for diabetes and possibly behavioral management and on occasion a TDOC telehealth consult through their payer or employer? Who will stitch all those disparate clinical observation pieces together for this patient to keep their LPR current? The patient, their care giver, their PCP, their payer – who knows – should we even care?

This will become an ever increasing issue and there is no easy solution today in the market to address it. But this also creates an opportunity for innovation. The new ONC/CMS interoperability rules provide a potential mechanism for an app vendor, working as proxy on behalf of a patient to pull these pieces together. However, this will require patient activation and therein lies the rub as to date, patients/consumers have had little inclination to do so.

Excellent article. Nice insights.

A lot of important questions asked in the conclusion. Hopefully they will all be answered soon by HIT developers. The key to overcoming existing challenges in virtual care is strong partnerships with organizations that specialize in healthcare IT development.

https://bit.ly/3iMAPRF