Key takeaways:

- Strategic services are increasingly coming into play as healthcare organizations struggle with a myriad of transformational challenges. Advisory Board’s broad array of services fills a significant gap in Optum’s overall, technology heavy portfolio.

- Optum now has direct access to the ABCO’s clients representing the C-suite of some 4,000 healthcare systems nationwide. Whether or not Optum can keep those clients on advisory services is another matter.

- Advisory Board’s Crimson analytics product is in wide use across the provider landscape but its capabilities have not kept up with newer entrants. This creates an opportunity for Optum’s analytics suite, OptumInsight.

- Optum has the potential to fill a significant need in the market for solutions that bridge both payer and provider markets in support of increasing collaboration and convergence between these two entities.

What Brought Us to Today

Optum and ABCO share a similar characteristic in that they were primarily built through acquisition. But unlike the Advisory Board, who had to sustain itself without a large parent organization, Optum has United Healthcare (UHG), a behemoth in the payer sector. Many of the solutions that Optum acquired over the years are being used today by UHG.

Within Optum, there are three distinct business units:

- OptumHealth: Provides care delivery, care management and health and wellness services that target large employers, payers and government.

- OptumRx: Pharmacy benefits management (PBM) service, again targeting employers, payers and government.

- OptumInsight: Suite of technology products and services with strength in analytics, population health and revenue cycle targeting providers, payers, government and life science markets.

In 2016, OptumInsight generated $7.33 billion in revenue making it arguably the largest healthcare IT vendor in the industry. It is within OptumInsight that the majority of ABCO’s assets will likely reside due to technology, market and services synergies.

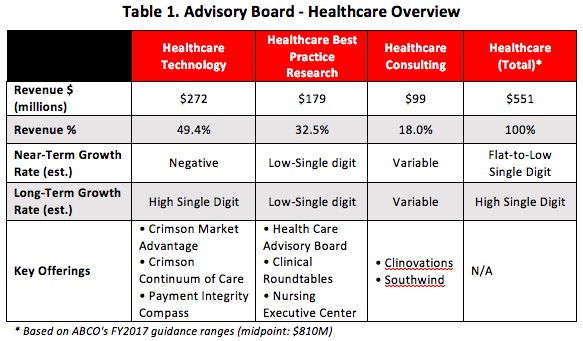

The Advisory Board is a well-known entity in the provider market providing both technology and strategic advisory services to provider organizations. For 2017, ABCO projected revenue in healthcare services of $551 million distributed across three main service lines (see Table 1).

Despite its broad and well-respected presence in the market, ABCO stumbled In last couple of years with lackluster growth and missed earnings estimates. Efforts to rationalize its diverse portfolio and trim expenses (RIF of 220 employees in early 2017) were in the works but these efforts were too little too late for impatient investors.

What’s Next

With the ABCO purchase, Optum now has direct access to the C-suite of most hospital systems across the country – a huge asset if Optum can maintain those relationships. However, many a hospital executive will be reluctant to fully trust a company that is directly tied to a payer. It is one thing to purchase technology assets from Optum, quite another to seek strategic advice.

How Optum negotiates this and maintains these client relationships bears careful watching. Other firms such as Accenture, BCG, Deloitte, Oliver-Wyman, PWC and the like will certainly capitalize on this opportunity. Looking ahead, Optum will have done well if it can keep at least 60% of these clients but it will likely be south of 40%.

It will be ABCO’s largest asset, its technology solutions including Crimson that will be the greatest benefit to Optum. These solutions are widely deployed across the healthcare sector and will provide Optum sales a ready entry into many a new account. The challenge for Optum will be to rationalize these many assets with its own technology solutions and providing existing ABCO clients a clear path forward.

As with advisory services, a plethora of healthcare IT vendors will readily go after these ABCO accounts. Optum will need to act quickly to reassure ABCO clients that their technology investments are sound and future-proofed. This will be a far easier task for Optum, a company well-versed in IT, data and analytics than their challenges in reassuring advisory service clients that Optum, owned by UHG, has their best interest at heart.

0 Comments