Over the past several months, we have been hearing over and over again how important the ‘young invincible’ demographic is for the viability of the ACA. Those young invincibles lower overall medical loss ratios (MLRs) for the population being served. The thought is, without these healthy young folks, how else are insurance companies going to be able offer affordable coverage to the older and sicker populations that were previously uninsured?

However, attracting this demographic to sign-up for health insurance on the health insurance exchanges (HIX) has been challenging. President Obama even went as far as being a guest on Zach Galifianakis’ parody talk show, Between Two Ferns to get the message out to the youth demographic that basically it is their civic duty to get health insurance. To a certain degree, this final push to engage the 18-34 demographic ended up being a modest success, with final enrollment numbers among this group representing around 28% of total enrollees after hovering at about 25% for the majority of the enrollment period.

Some view this as a success. Others are less optimistic. After hearing that a number of insurance companies are planning double-digit rate hikes, it’s pretty obvious that the success is very localized, and even more likely, merely political ‘spin’ (nothing you hear about ACA successes/failures are particularly unbiased). I have personally struggled a great deal with the decision about whether or not to obtain health insurance under the new individual mandate. My reasons are plentiful.

First and foremost, the economics just don’t add up. I have been uninsured in the state of Massachusetts for about four years now, ever since I decided to leave corporate life and pursue freelance work while starting a company. During this interval, I have had my fair share of sicknesses. This past winter was particularly frustrating as I contracted just about every cold that made the circuit. I also fractured my fibula backpacking and developed cellulitis in my hand after my dog bit me in the midst of an epic battle with another dog. These two incidents were my only real need for medical treatment during that four-year period and cumulatively cost about $2000 to treat. At this point, that’s an average spend of $500/year not including things like Advil or throat lozenges. There are plenty of Gold plans on the MA exchange for my age demographic that cost almost that amount alone for their monthly premium.

Bad Economics

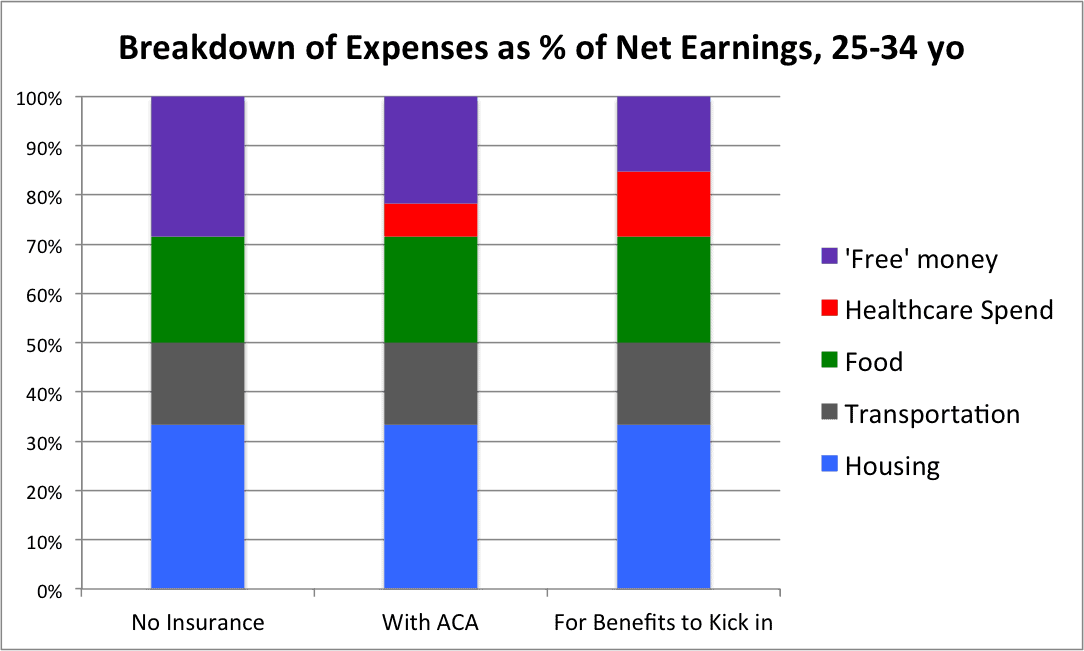

Let’s now do a quick breakdown on why insurance at the rates available on the exchanges just don’t add up for the young invincibles. According to the Bureau of Labor Statistics (BLS), the median weekly pay for the 25-34 demographic for the first quarter of 2014 was $727 before taxes. Assuming this is a salaried rate (big assumption), this works out to about $37800 in annual wages. At a 20% tax rate, this works out to be closer to $30,000/year net income – which, mind you, is a wage that does not qualify for federal subsidies so those will be left out of our calculations.

The mean for basic annual living expenses for 25-34 year olds are as follow:

- Housing (rentals only, includes utilities): $10,000

- Transportation (not including vehicle purchases): $5,000

- Food: $6,500

So, after accounting for basic living expenses, 25-34 year olds have only $8500 of net income left. BLS reports that pensions and social security account for an additional $5000 and apparel accounts for $2000. While not essential, these are still important to keep in mind as additional expenses that are incurred during the course of a fiscal year. So the average 25-34 year old is left with approximately $2,000-$8,500 in net income, with 15.7% of this population ‘debt distressed.’ I won’t even begin to go into college student loan paybacks…

Based on nationally reported exchange numbers, the rates for the cheapest available Bronze plans – which provide very limited preventive care coverage and $2000 deductibles that need to be met before any benefits kick in – had monthly premiums that ranged from $114-$286 for a 27 year-old non-smoker applying for coverage, with an average of $163. Annually that works out to be $1956 (6.5% of net earnings) to pay for something that doesn’t actually provide any medical coverage until patients have spent an additional $2000 to reach their deductible (figure 1).

Figure 1: Basic insurance adds approximately 6.5% to annual expenses for the ‘young invincible’ market for practically no coverage (high deductible of $2000). Meeting the deductible drives that percentage much higher, at 13.2%.

Now, anyone paying attention knows that there is a slight misdirection in that figure – there are bound to be some accrued health expenses across this population. According to the Healthcare Cost Institute, the average annual spend on healthcare per patient in the 26-44 yrs old demographic was $4123 in 2012, only $753 of which was paid out of pocket by consumers. This cumulative expense is shockingly close to the $3956 that would need to be paid by a consumer to even begin experiencing benefits under a bronze plan, and therefore there is not really any benefit to purchasing insurance, except for catastrophic events.

Why Bother?

Knowing full well that exchanges need my health to offset the expenses of chronically ill patients, the elderly, and everyone else that is less healthy than me, it seems a bit absurd that I should spend my money on a plan that would barely provide any coverage unless I become a high-utilizer (a whole different problem whereby the structure of our health system incentivizes poor health decisions).

So where is the incentive? Why would I want to bother? Right now the only real incentive is the disincentive tax penalty, which is a paltry $95 this year, or 1% of income.

Admittedly, my peers do tend to view themselves as pretty indestructible. Most of us live healthy lives, and accidents are rare. But accidents do happen, and unforeseen illnesses occur regularly, so insurance is certainly important to have long term. As has been proven over and over again in many different contexts though, spending time or money on something that gives no immediate gratification is a difficult sell. Add in that HIXs were plagued by bad software and horrible user experiences, and it comes as no surprise that the final enrollment numbers do not reflect the national demographics, where 40% of the uninsured population is 18-34.

Hopefully these issues are addressed going forward, and the administration, whoever it happens to be, thinks a little harder about how to motivate the youth to enroll. Current tactics are entertaining and gain exposure, and the HIXs are a great start to making costs and coverage options more transparent, but with networks narrowing and proposed rate hikes in the double digits, something is going to need to change or this part of the ‘grand experiment’ will fail before it gets a chance to take off.

0 Comments