This report is now offered free of charge – simply fill out the form at the bottom of the page. Brian Eastwood, lead analyst for this research, hosted a webinar sharing some of the key trends and findings from this report – view on-demand here.

Patient relationship management (PRM) is broadly defined as using multiple modes of outreach to help patients manage their health and coordinate their care in a disjointed care delivery system, all while living their daily lives. As payer and provider business models and technology strategies continue to converge under value-based care (VBC), PRM will shift from a task managed solely by provider organizations to a collaborative effort that involves providers, payers, and any third parties working on their behalf.

This Market Scan Report examines the market forces driving health care organization (HCO) interest in solutions that promise more targeted patient outreach, coordinated care management, and greater opportunity for patient self-management between care episodes. Motivating factors include serious limitations of legacy engagement solutions to meet business case needs and consumer usability expectations, the need to support patient engagement outside the four walls of the hospital, and economic factors that range from value-based care to provider-payer convergence to higher out-of-pocket costs for patients.

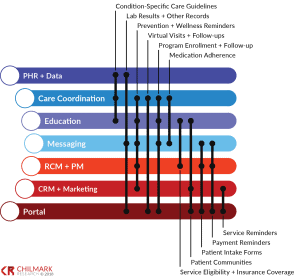

The research identifies more than 60 PRM vendors divided among 7 core competencies – each of which matches to a core functionality for supporting and enabling PRM:

To date, HCOs have adopted solutions to meet individualized engagement needs. Care coordination, messaging, and to a lesser extent data management have been priorities for high-cost and high-risk populations covered under VBC contracts. Solutions emphasizing patient acquisition and retention have served populations covered in fee-for-service (FFS) contracts. Portal technology has sufficed for HCOs striving primarily to meet federal mandates. Education solutions have support from bundled payment programs and other procedures where effective pre- and post-op preparation can generate costs savings as well as improved outcomes.

Over the next 24 to 36 months, as uncertainty about VBC payment models begins to wane, we expect PRM adoption to shift toward vendors that are better able to support broader care coordination efforts – regardless of their core PRM competency. Providers or payers looking for technology to support current and future PRM programs will find this report an invaluable aid to sifting through claims about the overall maturity of PRM functionality. Consultants, investors, employers, brokers, conveners, and others will also benefit from this in-depth research and analysis.

Vendors Profiled: Care Cloud, Cerner, Conversa Health, Docent Health, Epic, HealthLoop, Influence Health, Meditech, mPulse Mobile, Orion Health, Pegasystems, Salesforce, Solutionreach

Number of Pages: 54

Complete the form below for your free copy:

0 Comments