Once again, the Chilmark team is headed to Orlando for another HIMSS Global Conference and...

TEFCA Response Drives ONC to Reconsider

Key Takeaways: TEFCA proposed a new approach to healthcare data interoperability Industry response...

Changing of the Guard: Implications to Health IT Market

After a brutal election cycle, we are now on the other-side. The Republicans have taken control of...

CMS Drops MACRA Rules – 5 Things to Know About MIPS

Big news this week when on Wednesday CMS dropped the draft rules for MACRA, all 962 pages worth....

What Cerner’s DoD Win Means to Industry

So much ink, so little insight. Quite a lot has been published on the awarding of the large Dept....

New Insight Report on Moving to Open Platforms Now Available

All of the factors driving the adoption of platform thinking in the wider economy across other industries — escalating demand for better user functionality, customers seeking an outcome rather than a transaction, rapidly changing payment models — are present in healthcare. Yet HCOs and their HIT vendors cling tenaciously to closed, transaction-based systems and methods of doing business.

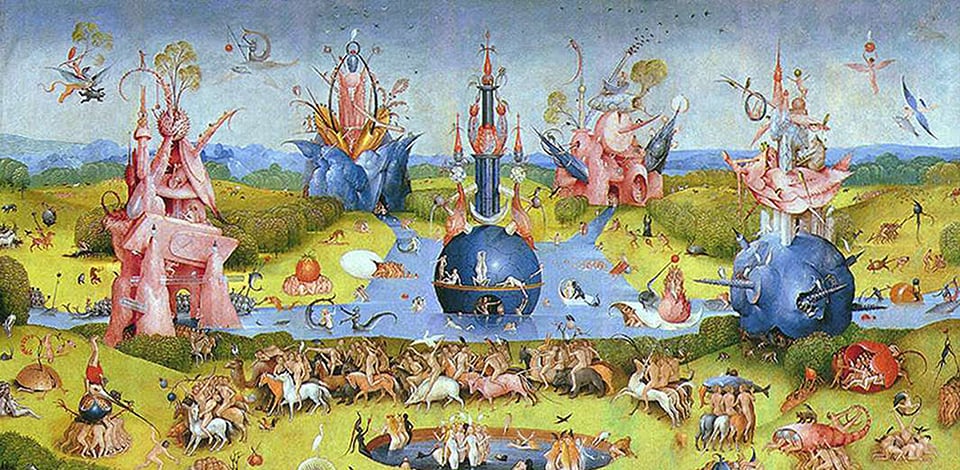

HIMSS Will not Have Dragons or Acrobats This Year: Clinician Network Management Watchlist

During the Middle Ages, London’s Bartholomew Fair grew from what we would call a trade show for...

Didn’t Like MU? Brace Yourself for the Interoperability Version

Join us today at 3PM ET for a tweetchat about MU3 and what the proposed regulations portend. Just...

ONC Catalyzing a National Interoperability Plan

ONC’s first draft of a nationwide interoperability roadmap is ambitiously vast in scope, but...