Ever-savvy Oracle is all but certain to profit from the Cerner acquisition, but what’s ahead for Cerner’s customers, clinicians and the EHR market?

The Continued Bipartisan Push for Transparency

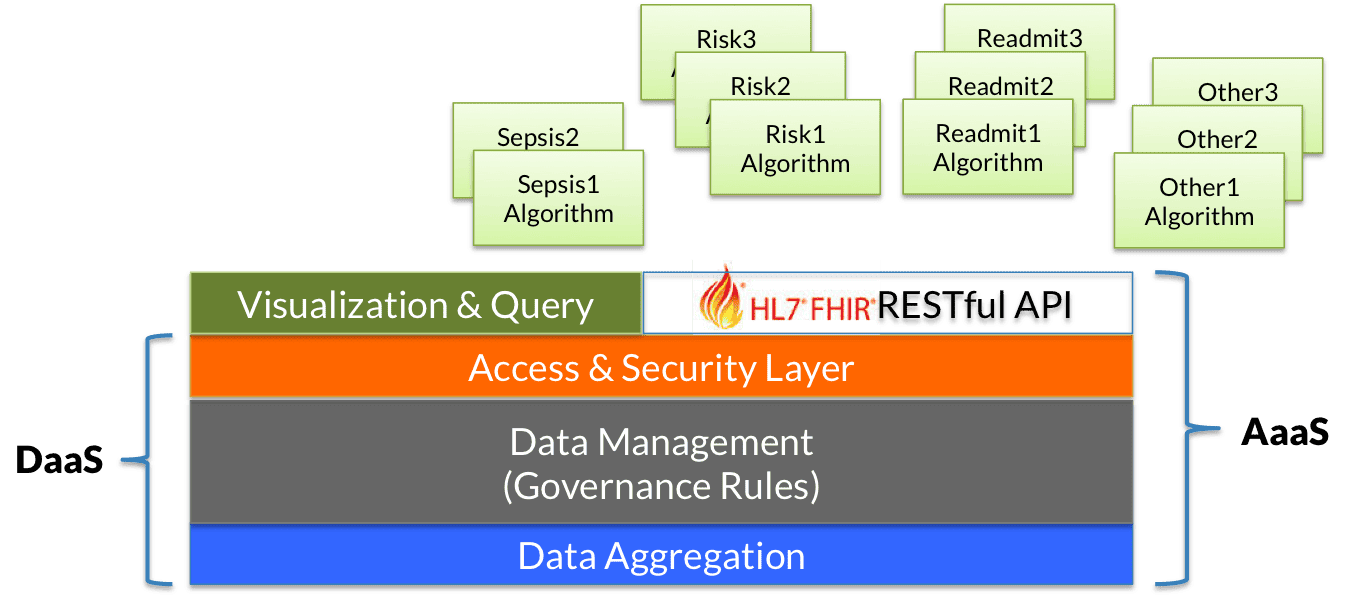

Our latest Market Trends Report, Integration Infrastructure: Building 21st Century HIT, provides a comprehensive snapshot of a variety of new and different approaches to development and integration that will harness data across organizations and applications.

Hot Take | Immunization Tracking: A Uniquely Pertinent Case for Interoperability

In this Hot Take, our Director of Research, Brian Murphy, digs into a timely example of one of the important ways healthcare interoperability is currently lacking: easily accessible immunization records.

Top Three Factors Driving Growth in Cloud Analytics for Healthcare

So here is a scary thought for all those who fear the move to cloud services due to cybersecurity...

Watson Gets Data, But Does IBM Get Health?

IBM’s made a big bet with Watson Health, but will the technology live up to the marketing? They are off to a great start – though their work is certainly cut out for them.

New Insight Report on Moving to Open Platforms Now Available

All of the factors driving the adoption of platform thinking in the wider economy across other industries — escalating demand for better user functionality, customers seeking an outcome rather than a transaction, rapidly changing payment models — are present in healthcare. Yet HCOs and their HIT vendors cling tenaciously to closed, transaction-based systems and methods of doing business.

#WWBR Week of February 23, 2015

Study Urges Greater Financial Disclosure by Nonprofit Integrated Health Systems Jill Bronstein in...

Longitudinal Care Plans: Still Siloed

I have been doing a lot of work and research around the current state of care plans for an...

athenahealth Acquires RazorInsights: Can athenahealth Succeed Where Others Have Failed?

Success? On Wednesday, January 14, athenahealth announced it will acquire the cloud-based EHR...