Anyone who has listened to a recent WebMD quarterly results webcast clearly understands where WebMD sees growth. Not too surprisingly, it is not PHRs via customized portal solutions for payers and employers, despite them having over 250 clients including such household names as EMC, IBM, WellPoint and numerous BCBS plans.

No, it is in advertising and marketing. WebMD sees a big opportunity here as healthcare companies, particularly drug companies, look for new approaches to reach the consumer beyond traditional media. Being the number one site for healthcare content with clear Brand recognition, they have a commanding lead on their competitors, something Revolution Health could not overcome despite all the $$$ invested.

But on the Internet where everything moves at a frenetic pace, such leads may be fleeting even for a company like WebMD, who must constantly look over their shoulder. With both Google and Microsoft getting into the consumer healthcare market, WebMD’s long-term prospects are not assured and vigilance and aggressive moves will be necessary.

One such move is the announcement this morning by WebMD to acquire QualityHealth.com and parent company MTS Corp. MTS (Marketing Technology Solutions) is just what its name implies, a company designed to offer healthcare companies (primarily drug companies) a channel to the consumer market, that channel being the QualityHealth website, though they do have other Internet properties as well including Nubella, a nutrition specific site and Healthpages, a yellow pages like directory for finding healthcare service providers.

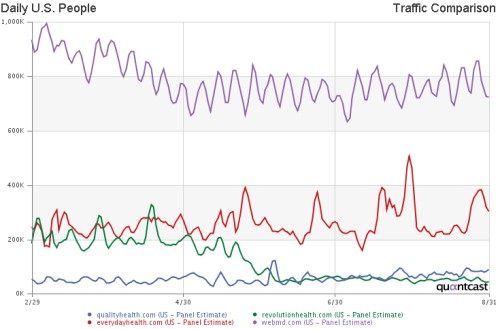

The QualityHealth website is just another one of those cluttered consumer-facing health content websites with an amalgamation of health related news, a number of health related tools, e.g., the all too common BMI calculator, some social communities (which were deceptively poor – lots of cross-posts to make communities seem more active than they really are) and of course, advertisements everywhere. More duplicative of the existing WebMD and not as well executed. Taking a look at traffic statistics on Quantcast and comparing them with those of the recent post on Everyday Health, QualityHealth ranks fourth not far behind the sinking ship of Revolution Health.

So why would WebMD acquire such a property?

First, MTS has a nice list of clients and partners that WebMD can further leverage across numerous properties. Secondly, MTS “claims” to reach 9 million consumers per month via its three properties. Third, MTS has an internally built analytics, rules-based engine for targeted ads and promotions that WebMD may find some value in. Fourth, and maybe most important, we are seeing consolidation in the broad category of consumer healthcare sites as there are simply too many in the market today and traction is waning. Fifth, WebMD got a good price for MTS.

Why a good price?

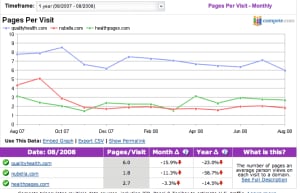

Looking quickly at the MTS properties via compete.com, one sees that though the QualityHealth site is seeing growth, the other two properties are virtually stagnant over the last year (first figure below). Secondly, when one looks at average length of stay at these properties as well as page views, each important metrics to assess stickiness of a site, these properties are stagnant or worse slipping.

Bottomline:

Expect further consolidation in the market as larger players with deeper pockets (e.g., media companies, established Web properties and others) pick-up those with an established presence, a client base and stagnant growth.

Update:

WebMD paid ~$50M for MTS which reported sales of $21M in 2007. Assuming modest growth in 2008 puts sale at roughly 2x revenue. But WebMD will pay a bonus of $25M if certain performance metrics are met.

I like this site, very well organized, with good content. I’ll definitely check back in…Thanks