As capable allies in our collective fight against the pandemic and capable managers of community well-being (e.g. chronic disease management), [community partners] deserve equal attention and assistance.

How Convergence Benefits Rising-Risk Patients

By Mark A. Caron, FACHE, CHCIO, Geneia CEO No matter how you look at it, the toll of diabetes and...

Cerner Health Conference 2018: Interest in PHM Solutions Remain ‘Healthe’

By Matt Guldin and John Moore Recently, we and 12,000+ others attended the Cerner Health...

MEDITECH Look Ahead: Building on Steady Progress

Key Takeaways from MEDITECH's Physician and CIO Forum 2018: MEDITECH is moving its customer base...

Opening New Front Doors to Care: Reflections From Bridge to Pop Health East

For all the promise of patient engagement technology such as chatbots, wearables, self-management...

What’s All the Fuss – Some Thoughts on Recent News

At times it can be challenging to draft commentary on all that is happening across this industry...

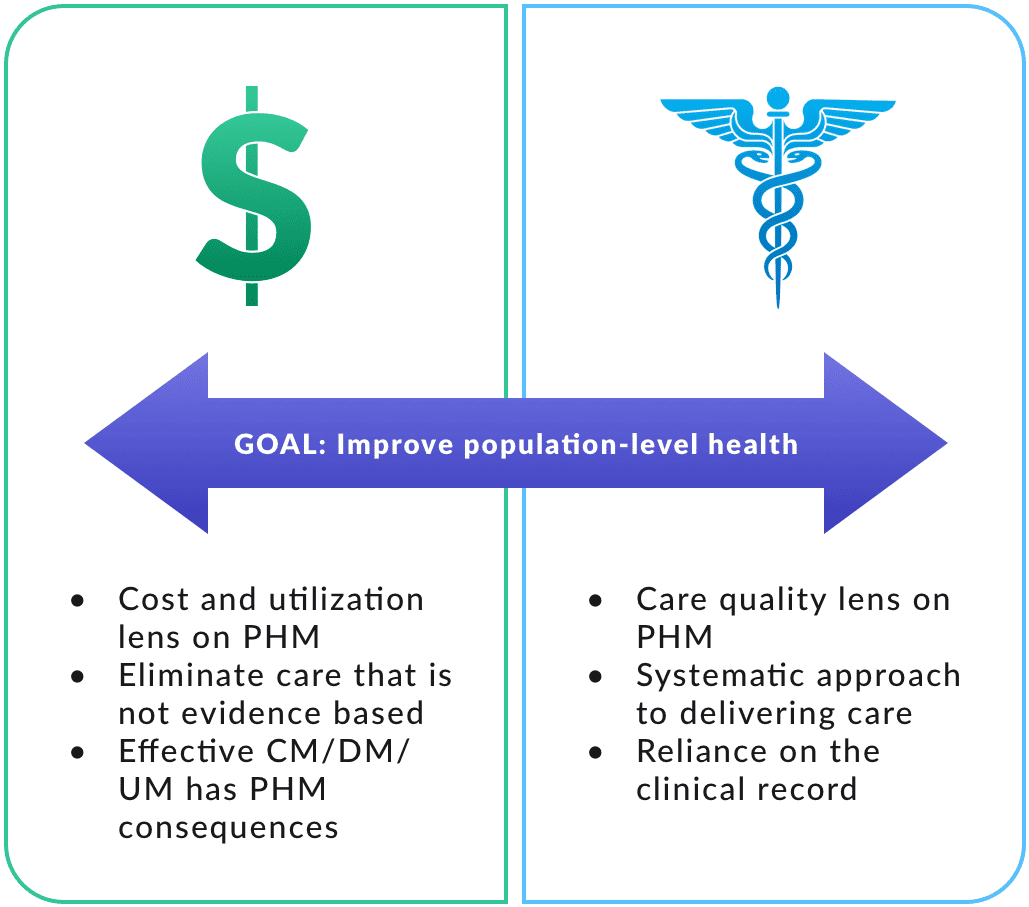

Podcast: The Convergence of Providers and Payers

A critical path forward, fraught with challenges Chilmark's founder and president John...

PHM Market Trends Report Coming Before HIMSS

Key Takeaway PHM products are maturing in spite of uncertainty about payment system. The Chilmark...

Back to the Crystal Ball: Our 2018 Healthcare IT Market Predictions

Our favorite post of the year is this one. As analysts, we come together with our propeller hats...