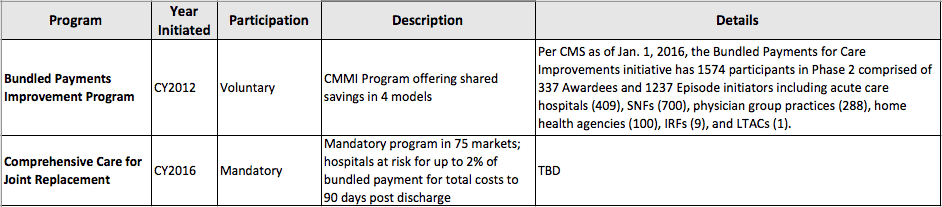

No this isn’t a post about the latest Michael Bay sequel in the Transformers’ movie franchise. Instead, I wanted to focus on the acquisition last month of Curaspan, a leading vendor in discharge planning, by naviHealth. This is the second health IT acquisition by naviHealth in the last several months having also acquired RightCare Solutions in Dec. 2015. RightCare Solutions had developed proprietary technology to identify the risk for admitted patients and focused on matching patient to the right-level of post-acute care and applicable services. naviHealth itself had just been acquired by Cardinal Health which acquired a majority share of the company in Aug. 2015. naviHealth partners with health plans, health systems, and providers to manage the post–acute care continuum by provide services and solution offerings. At the time of its acquisition last fall, it served nearly 2 million members and had partnered with over 75 hospitals and physicians groups. One of its more interesting roles though is as a convener in the CMMI program for bundled payments.

When the convener enters into the agreement with for the CMMI program, it will receive the payment of the difference between the target price and FFS payment upon episode reconciliation. It must assume financial risk for exceeding the budget. It also is expected to make payments to the participating providers as specified in contracts between the convener and those providers. A convener applying to be an awardee must specify in the application the financial arrangements that will allow the convener to bear risk. Under this model, a health plan, a freestanding not-for-profit organization, a consulting firm, or anyone who could demonstrate the requisite financial credibility could perform this function.

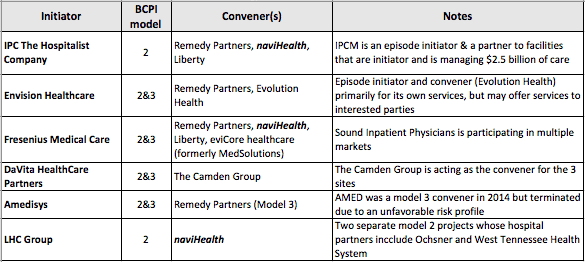

To date, naviHealth has been chosen as a convener by several participants in the CMMI program participating in Model 2 & 3 (see Table 2). Figures are not available on the number of conveners without more detailed analysis but it raises some interesting questions as bundled payments become more prevalent on what roles conveners are going to possibly play including:

- What types of evidence-based site of care selection, length of stay management, transition coaching, and environmental needs assessment will they provide and how will this be incorporated into the discharge planning process including the patient’s care plan?

- Do they have a proprietary solution(s) that creates & generates a discharge planning document, transmits and send the discharge planning document to the SNF or other post-acute providers as necessary?

- Do they have a mean of sending or distributing clinical messaging as relevant during the discharge process period (e.g., 30, 60, or 90 days)?

- What types of analytics are these conveners providing on post-discharge site selection and recommended services that a patient will need especially if they are being sent directly to their home?

- What types of additional personnel and services do they are potentially provide?

The Care Management Market Trends Report we just finished found that while vendors in the report state they could their solutions enable transition management (primarily centered on the hospital discharge process) the reality today is that these solutions primarily could generate a summary-level document containing including the patient’s care plan & its relevant data elements but not begin to enable wider care coordination. While the naviHealth business is expected to have a limited impact on FY16 and FY17 earnings for Cardinal Health, the business provides an important solution for the transition of care to post-acute settings. With an increased focus on care transitions and post-acute care settings given the bundled payment and value based care initiatives, the naviHealth business will give also give Cardinal Health more opportunity to cross sell products and services in multiple care settings across the continuum of care as well. The recent acquisitions by naviHealth are a step in the direction of providing some of these solution capabilities to address this particular process and it will be interesting to track what other conveners do in this market segment particularly Remedy Partners and what additional partnerships (or acquisitions) that some of the conveners plan to make or if they are acquired outright as naviHealth was by Cardinal Health last year.

Admin, if not okay please remove!

Our facebook group “selfless” is spending this month spreading awareness on prostate cancer & research with a custom t-shirt design. Purchase proceeds will go to cancer.org, as listed on the shirt and shirt design.

http://www.teespring.com/prostate-cancer-research

Thanks