Key Takeaway

Key Takeaway

- PHM products are maturing in spite of uncertainty about payment system.

The Chilmark Research 2018 Population Health Management Market Trends Report, long in development, will be released immediately before HIMSS in March. This report profiles 25 vendors and describes the technology landscape for enabling a population health management (PHM) strategy.

Why a PHM Market Trends Report Now?

We hesitated to release a report on this emerging market for several years. Until recently, most available solutions were not able to fully address the range of provider requirements for PHM. The earliest solutions focused on the needs of Healthcare Organizations (HCOs) caring for Medicare Shared Savings Program (MSSP) patient panels. Over time, vendors added functionality to support bundles and private payer requirements requiring a good understanding of quality, costs, and utilization.

Another reason we held off with this report had to do with provider readiness. Healthcare delivery organizations needed time to incorporate these capabilities into their processes and workflows. The earliest HCO adopters of PHM relied on a variety of manual processes to conduct their PHM programs. Most HCOs lacked extensive experience with one or more of the constituent functional domains of PHM to fully utilize and benefit from the technology.

By early 2018 vendors had amassed significant experience building, managing, and supporting PHM enabling technology for providers and payers. Virtually all HCOs realize that PHM will be an increasingly important part of their operations and influence a significant percentage of their future revenue streams.

Virtually all HCOs realize that PHM will be an increasingly important part of their operations and influence a significant percentage of their future revenue streams.

Uncertainty About Value-Based Healthcare Makes Providers Pause

PHM’s close association with value-based care and payments cements its reputation as both a key strategy and technology enabler for transforming the U.S. healthcare system to achieve the goals of the Triple Aim. The PHM market’s growth closely mirrors the growth in value-based reimbursement (VBR). The pace of transformation to the payment system has not been smooth, and the Centers for Medicare and Medicaid Services (CMS) has sent mixed signals about its future in 2017. The business mandate for providers to embrace PHM slowed in the last 12-18 months. Provider concerns about revenue or market share losses have dampened enthusiasm for changing the fee-for-service (FFS) status quo. But the overall trend is moving in one direction: Away from FFS.

While uncertainty about the fate of value-based payments restrained provider’s embrace of PHM, the number of accountable care organizations (ACO), clinically integrated networks (CIN), and other risk-bearing programs continues to grow. Providers of all sizes have come to terms with the inevitable move to value-based contracting. ACOs will serve 10.5 million Medicare patients this year, a 17% increase over 2017. Delivering care to this expanding panel of patients requires providers, and in particular primary care providers, to organize themselves to make their PHM efforts successful. A variety of community based organizations, such as regional or state-level health information exchange organizations and to some extent payers, are also beginning to see the need to build and run PHM programs for, or in concert with, their provider partners.

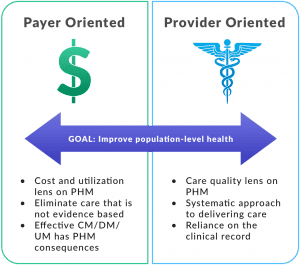

Evolving Perception of PHM and the Four Technology Domains

PHM means different things to different people in 2018. Vendors built on products for pay-for-performance (P4P) programs to support CMS’ original set of ACO programs. Vendors, as a result of both organic development and acquisitions, now offer more PHM related functionality then they did a few years ago. While it is too early to say that PHM requires an established and fixed set of capabilities, the general outlines of the technology to enable a PHM strategy are broadly understood to fall into four technology domains:

- Analytics

- Care management

- Patient engagement

- Data aggregation

Most of the vendors in this report have special expertise with one or a few of these domains.

As recently as a few years ago, analytics products provided the key enabling function for most PHM programs. While this functionality has an indispensable role in PHM programs, its core functionality – cost and utilization analytics and clinical quality monitoring – is arguably the most mature aspect of existing PHM solutions. Attention has shifted somewhat to care management. The value proposition for care management stems from a perception that these workflows are the “tip of the spear” for PHM generally. Care management products are often the central tool for organizing and running PHM programs on a day-to-day basis. Payer-oriented solutions with case, utilization, and/or disease management legacy have transferable skills for clinically oriented PHM. These vendors are beginning to make inroads into provider markets. Care management capabilities are less mature than analytics but are undergoing the most rapid pace of change by vendors.

The least mature aspect of PHM from a functional standpoint is patient engagement. In most of the solutions described in this report, the care management product supports some level of interaction between patients and a care team, mostly relying on a patient portal or app. Telephonic interaction with patients still seems to be the dominant method for most providers.

Data aggregation and data source management are core competencies for PHM. They form the foundation for all of the other domains of PHM. Managing diverse data sources is complex in all PHM sub-markets and for every organization developing PHM programs. Transactions, messages, documents, and files flow in from different organizations. These sources need to be reconciled, deduped, monitored for quality, and have all of their various records matched to patients, providers, organizations, health plans, and contracts. Organizations express this data using a multitude of formats and vocabularies. Vendors must constantly monitor these transfers and streams for quality, timeliness, and completeness. Every vendor in this report has skills in this regard but they differ in the scale at which they can operate. The number of organizations and sources from which they can ingest and process data is shaping up to be an important differentiator for providers. This set of capabilities is marked by fairly mature technologies and techniques but they are being deployed against a rapidly expanding universe of health-related information.

EHR Vendors Do Not Own the PHM Market

No vendor today has anything like a “PHM Platform.” The largest EHR vendors aspire to develop such an offering and have the resources to pull it off. Hospitals and health system turn to these vendors for all of their PHM needs, but it is not unusual for them to assemble their own solution from a variety of vendors supplemented with internally developed capabilities.

But these offerings come with price tags with little appeal outside of the large HCOs. Independent physician practices, most with limited budgets and no significant IT development staffs, are more interested in turnkey capabilities from a single vendor. Often this means their EHR vendor, but just as often it means an independent vendor with a full range of PHM capabilities. While EHR vendors are fielding increasingly full-featured solutions, they have not cornered the market.

Bottom Line

Not all providers and payers have fully embraced value-based care and payments but the need for, and interest in, enabling solutions for PHM continues to grow. Armed with this report, providers can distinguish between the capabilities and services needed to help them meet their complex information and workflow needs for multi-disciplinary, multi-organizational teams striving to optimize the health of populations. This report will help providers sort through the different vendors and solutions in this confusing market.

0 Comments