Chilmark Research launched the Care Coordination domain (now Care Management) in an effort to bring clarity to a diverse and emerging market that had yet to be subject to formal, in-depth analysis. Dozens of vendors from all over the health IT map – analytics, clinician network management (CNM), electronic health records (EHRs), payer-oriented systems, and engagement platforms – offer their own version of a care management “solution.” This broad range of core competencies makes it difficult to weigh the strengths and drawbacks of these solutions on their own.

That’s why we are pleased to announce the release of our 2016 Care Management Market Trends Report. This report represents the culmination of months evaluating numerous technologies and vendor road maps, as well as defining a vision for the Care Management Life Cycle.

At its core, care management is about delivering the right care in the right setting at the right time, all in the name of closing the care gaps that lead to unnecessary hospitalizations, readmissions, duplicated treatments, and the onset of comorbidities.

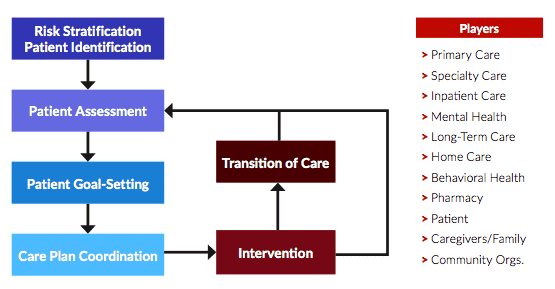

This sounds simple – and is the backbone of many a sales pitch – but the reality of care management is a series of interconnected workflows. As patients move through the care management life cycle, case managers must coordinate risk scores, assessments, treatment goals, care plans, interventions and, if necessary, care transitions, all while coordinating with medical professionals within and outside the hospital, community organizations, and the patients themselves.

Until recently, this has been a largely manual process dominated by phone calls, faxes, brochures, and printed orders. Communication has occurred in fits and starts, and longitudinal care plans have been little more than a pipe dream.

Enter care management solutions, which aim to streamline the steps of the care management life cycle. We say “steps” because, as is the case with the population health management (PHM) market, no one care management solution has everything covered at this time. As such, no vendor received an “A” in our final rating.

Most vendors struggle to grow beyond their core competencies and existing customer bases – and those developing “best of breed” care management solutions struggle to find a place among the myriad IT systems healthcare organizations (HCOs) already have in place.

That said, the vendors evaluated in the Care Management Market Trends Report – 22 established vendors and nine startups – recognize their faults. Improving patient engagement is a priority for many. So, too, is incorporating evidence-based care plan guidelines.

It’s too soon to tell whether best-of-breed care management vendors will prevail over those that have started from their core competency – namely analytics and EHR – and intend to build off their existing customer base. Our report shows that the care management market is immature at best; it will take at least three years for vendors to find out if they have solid footing beneath them.

For sales inquiries, please contact Sean Campbell, or go to the report sales page to purchase directly.

0 Comments