Despite slow macroeconomic shift, VBC solutions continue advance to meet evolving healthcare needs

The shift to value-based care (VBC) has long been an industry talking point in healthcare, among vendors, providers, and patients alike. Perhaps predictably, for a sea change of this magnitude, migration to these new reimbursement models has been slow. Notably, COVID-19 hammering hospital systems’ typical fee-for-service business model left little wiggle room to implement a new pricing structure like the VBC model, and some systems that had planned for the shift were forced to backtrack.

As value-based care becomes increasingly seen by policy makers as the most viable option to “bend the cost curve,” policy and incentives are aligning for the adoption of value-based care. IT-based solutions are becoming more robust, while legislation like TEFCA and the 21st Century CURES Act are cementing the direction forward.

So, what would it take for a hospital system to successfully drive this shift to VBC? What solutions can health IT vendors bring to market that facilitate this transformation? In Chilmark Research’s latest report, “Analytics for Value-Based Care”, we examine the leading vendors who are tackling this problem with analytics solutions that are foundational to success in any VBC program.

The Center for Medicare and Medicaid Services (CMS) has been leading the migration to VBC through a number of programs, many of which now have downside risk. Most notably are the Medicare Shared Savings Plan (MSSP), an accountable care organization (ACO) model, and Medicare Advantage. The new REACH ACO model goes even further towards capitation.

Medicaid, administered at the state level, is also increasingly moving to VBC models of reimbursement. Today, several states have migrated their Medicaid payment structure to a full capitation model, wherein provider organizations are paid a fixed, negotiated fee per patient per month.

Commercial payers are also following the government’s lead, most notably through Medicare Advantage, and some large, self-insured employers are pursuing VBC via direct contracting with health systems.

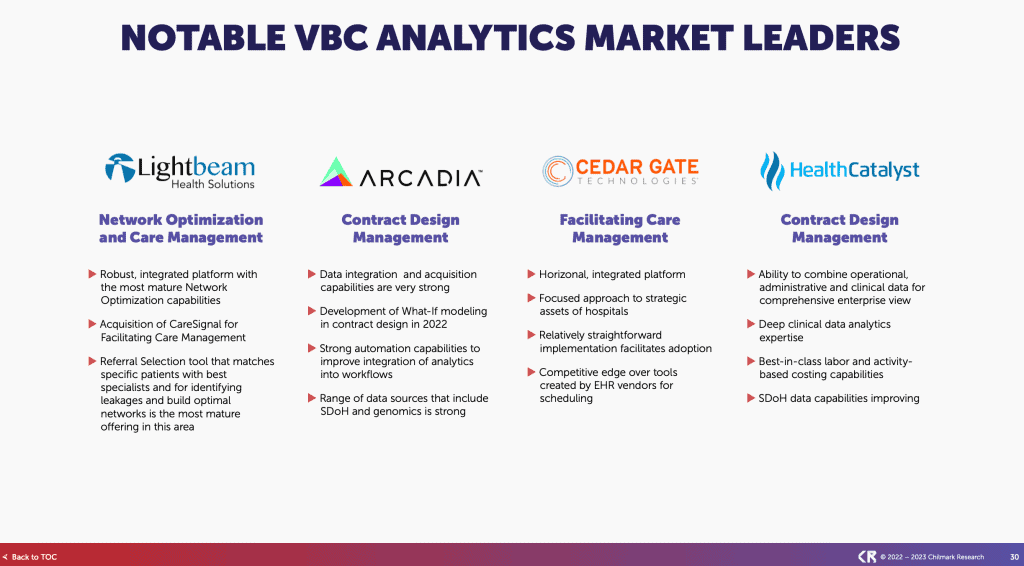

There are three main functional analytic categories for VBC: network design and optimization, facilitating care management (includes population risk assessment), and contract negotiation/management. In “Analytics for Value-Based Care”, we examine, evaluate and profile 17 leading vendors. Our analysis combines primary and secondary research, including in-depth demos with each vendor, to assess the relative strength of their solutions to facilitate a health systems migration to VBC.

This research report will assist all healthcare stakeholders in understanding what is available in the market today and the relative strengths of each vendor in helping provider organizations migrate to VBC. No other report provides this level of depth and breadth to assist organizations in becoming a data-driven enterprise and being successful in their future journey to VBC.

Vendors Profiled: Arcadia, athenahealth, Cedar Gate Technologies, Oracle Health, Change Healthcare (Now part of Optum), Clarify Health, Health Catalyst, HealthEC, Innovaccer, Lightbeam Health Solutions, Medecision, Merative, Milliman, NextGen, Optum, Persivia, SPH Analytics (Now part of Press Ganey)

Standard Price of Report: $6000 $4,000 | Qualified Care Delivery Organization: $375*

$4,000.00Add to cart

*Please submit a request for a discount code to unlock the reduced rate.

Report purchase includes a 45-minute consultation with the author(s).

Below you can find some of our related coverage of this topic:

- Regulation as a forcing function for innovation feat. Micky Tripathi, HHS’ National Coordinator for Health IT (February 2024)

- Platforms, AI, Real-World Data, Engagement, and Genomics: Epic Plays this Year’s Hits at UGM23 (September 2023)

- Getting Real with Healthcare Data: RWD/RWE Enabling New Models of Research and Care Delivery (September 2023)

- Automation and Care Orchestration: Envisioning the Future of Care Delivery (May 2023)

- Next Generation Utilization Management through AI (January 2023)

- Race, Data and the Complexities of Health Equity (December 2022)

- Addressing Social Determinants of Health: IT Solutions to Engage Community Resources (November 2020)

0 Comments