This report is available to subscribers of the Chilmark Advisory Service or may be purchased separately by clicking below. To accompany the release of this report, lead author Brian Murphy hosted a webinar in which he shared some of the key findings of this report and answered questions about the trends in analytics that are driving modern changes to healthcare delivery.

2019%20Healthcare%20Provider%20Analytics%20Report_preview Purchase

UPDATE (11/13/2019): The companion report on payer analytics is available now!

Our extensive research for this report uncovered a market wherein today’s leading analytics applications are beginning to address broader needs than just VBC. This is causing greater separation in the relative capabilities of vendor solutions in the market today, with some vendors still primarily focused on VBC and care management needs, while others move to address EPM.

Analytics Across the Continuum

This comprehensive report provides an overview of the market for provider enterprise analytics and evaluates offerings from 23 vendors. It finds that vendor offerings mirror EHR penetration. Providers in acute and ambulatory settings have many choices for analytics across multiple use cases. Providers in post-acute settings and others with low-EHR penetration have relatively fewer choices.

Traditional and Advanced Analytics

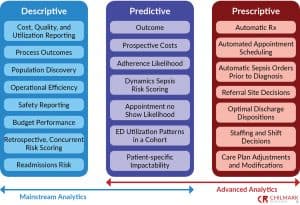

This report characterizes current analytic solutions as either “mainstream” or “advanced.” Most HCOs have experience with mainstream analytics – applications that characterize and summarize current performance. While the underlying technology and general approach is well-established, mainstream analytics has yet to supply a robust predictive insight and prescriptive guidance; for that, HCOs are looking at advanced analytics.

Advanced analytics consists of interrelated technologies, the most common of which are artificial intelligence/machine learning, natural language processing (NLP) and extraction, and big data technologies. These technologies and techniques, while not widely deployed in healthcare, are all used to varying degrees by most of the vendors profiled in this report. The expectation is that as these technologies mature, advanced analytics will offer more accurate predictive and prescriptive capabilities.

Vendors were compared on a specific set of consistent product capabilities and market execution metrics. To provide a detailed basis for comparing the offerings of different vendors, we broke down analytics functionality into the following categories:

- Clinical and Claims Data Contribution, Other Data Contribution , Analyst and Developer Support, Scope of Applications, Benchmarks, Care Management , Clinical Quality, Cohort Discovery, Registries, Healthcare Costs, Risk, Network Analytics, Predictions, Utilization, Operations, User Support, Self-service Analytics, and Application Design

We defined the following categories as appropriate metrics to compare vendors on market execution:

- Market Vision, Extensibility and Engagement, Complimentary Services, Market Momentum.

Vendors Profiled: Allscripts, Arcadia.io, athenahealth, CareEvolution, Cerner, Change Healthcare, eClinicalWorks, Epic, Forward Health Group, Health Catalyst, HealthEC, IBM Watson Health, Innovaccer, Lightbeam, MedeAnalytics, Medecision, MEDITECH, NextGen, Optum, Philips, SCIO Health Analytics, SpectraMedix, and SPH Analytics.

Report Length: 72 pages

Cost: $6,000

To learn more about this report, please contact John Moore with any questions.

2019%20Healthcare%20Provider%20Analytics%20Report_preview Purchase

0 Comments