Collective Medical got an eye-popping $650M in sale to PointClickCare – was it worth it?

This week we learned that Collective Medical will be acquired by Canadian-based PointClickCare for a whopping $650M. That is a phenomenal multiple to Collective Medical’s estimated annual revenue of about $45M. Is it an unreasonable valuation? No, and here’s why.

One of the biggest challenges that will face the healthcare sector in coming years is the increasing fragmentation of care and the need to build data bridges across venues of care.

The options for consumers to gain access to healthcare services is expanding rapidly. From telehealth, to urgent care, to basic primary care services at your local Walmart or Walgreens (partnership with VillageMD). And let us not forget the increasing role of payers in this dynamic as they look to become more vertically integrated. Oh, almost forgot, you also have your local PCP and hospital to provide such services.

In the not so distant past there was the move to establish local and regional HIEs to assist in providing clinicians a complete picture (longitudinal record) of a given person’s health. These HIEs struggled for relevancy as few providers wanted to share their patient records with competing health systems.

Fast forward to today and layer in the number of choices now available to a consumer/patient to receive care, both locally and from abroad (telehealth) and the idea of putting together that holy grail of the longitudinal record looks downright insurmountable.

Back to the Drawing Boards

Despite all of the attention that the Cures Act and FHIR have received, the timelines for these to become real and widely adopted across the healthcare sector is still years away. The industry needs solutions now.

Clouded by the COVID pandemic, in March the Cures Act was promulgated into law. Plenty has already been written on this subject so I will not dwell on it anymore than to say the move to open standards and FHIR APIs will alone not solve the fragmentation of care. Now don’t get me wrong, the Cures Act is a huge step forward for this industry but in and of itself, it will not address the multitude of issues that exist anytime soon. With the increasingly rapid move to value based care, healthcare stakeholders are looking for solutions today.

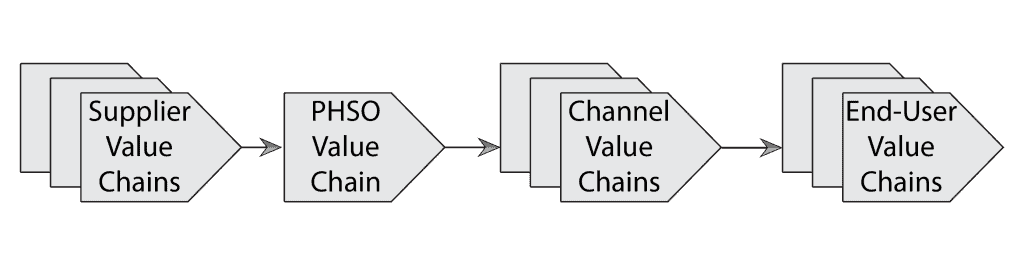

At the beginning of the year we released A Path to Value for Population Health (FYI, its free for download). The report was the culmination of several focus groups with healthcare leaders across the country on their PHM strategies. A key finding was the need for providers to adopt a strategic, “Value-Chain Model” to address PHM.

Having personally come from a manufacturing background, I have also looked at the healthcare sector through that lens in seeking to find what best practices in manufacturing could be adopted in the healthcare sector. One of my first “ah ha moments” was realizing that care delivery is really a supply chain issue – the delivery chain – where you have an input (patient) and product (patient post-procedure or chronic).

This view sheds some light on where the next big opportunities may lie in the health IT sector.

Stitching Together the Delivery Chain

PointClickCare’s acquisition of Collective Medical is similar to competitor WellSky’s acquisition of CarePort from Allscripts. In the WellSky example, CarePort received about a 13x multiple on revenue, $1.35B price tag. Thus, the multiple for Collective Medical does not seem so out of line with what the market is willing to pay.

Both WellSky and PointClickCare are working from the outside in on the care delivery chain. Each are focused on post-acute care in skilled nursing facilities (SNFs), long-term, post-acute care (LTPAC) and the rapidly increasing market for home healthcare services. With their respective acquisitions of CarePort and Collective Medical, these two companies are seeking to establish secure connections with acute care to optimize transitions in care – basically addressing the care delivery chain from acute to LTPAC/SNF to the home.

Supporting Future Value-based Care Models

It is no secret that current transitions in care from acute to SNFs/LTPAC are problematic and a major contributor to unnecessary costs. These costs were easily hidden in a fee for service world.

But as VBC models, especially Medicare Advantage and capitated models for Medicaid continue to gain prominence, the need to insure seamless transitions in care along the delivery chain becomes paramount to reduce risks e.g., hospital readmits. Despite all of the attention that the Cures Act and FHIR have received, the timelines for these to become real and widely adopted across the healthcare sector is still years away. The industry needs solutions now.

These two acquisitions show that a significant opportunity exists today to stitch together that delivery chain with data feeds. All I can say is: It’s about frickin’ time!

0 Comments