It is now nail-biting time, as we here at Chilmark Research brace ourselves for the upcoming Supreme Court decision on the legitimacy of the Affordable Care Act. We as a nation are indeed living in very interesting times and I am again reminded why I find healthcare markets endlessly fascinating (and perplexing). (Editor’s note: This post was written by senior analyst Cora Sharma and highlights some of her latest research that looks at payer strategies for patient/member engagement.)

It is now nail-biting time, as we here at Chilmark Research brace ourselves for the upcoming Supreme Court decision on the legitimacy of the Affordable Care Act. We as a nation are indeed living in very interesting times and I am again reminded why I find healthcare markets endlessly fascinating (and perplexing). (Editor’s note: This post was written by senior analyst Cora Sharma and highlights some of her latest research that looks at payer strategies for patient/member engagement.)

Of interest is just how many of the ~30 million uninsured US citizens will land on insurers’ doorsteps in 2014. Even if the Individual Mandate is upheld, it is still uncertain just how many of these uninsured individuals will opt to pay penalties rather than purchase health insurance.

For my patient engagement research, I have spent the past several months speaking with executives at large payers about their consumer-focused strategies. Just how are payers planning on using relevant consumer technologies to keep new individual customers engaged and healthy? After such a dismal track record over the years around health/wellness/DM initiatives, is it worth another go-around? (Cora’s research will culminate in a forthcoming report to be released within the next couple of weeks.)

Payer Initiatives in Consumer Technologies

Kaiser Permanente and Humana actually began experimenting in this area circa 2008, creating flash-based, online health games for children. In 2010, UHG released the first version of the OptumizeMe social game App, Anthem released its Grocery Guide App (now EOL), and Aetna partnered with OneRecovery.com to provide a social network for members in recovery.

Now all of the major payers have ongoing products, partnerships, and pilots around consumer-focused health and wellness and disease management — though with varying respective strategies (the upcoming report explores these 35 ongoing payer initiatives in detail).

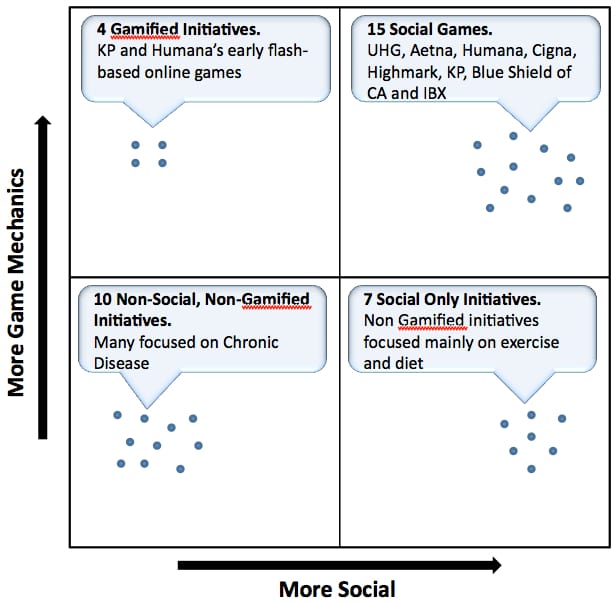

The figure below shows an interesting slice of data around social games, in that the majority of these initiatives are becoming social and ‘gamified’:

Note: Data point positions do not represent degree of gamification/ social-ification. These are just meant to illustrate number of initiatives in each category

Another trend our research has found is the willingness of payers to look beyond health and wellness and towards the complex FDA-regulated space of chronic disease management solutions (partnering with Healthrageous and Welldoc), as well as seeking to improve member ‘Wellbeing’. Aetna’s partnership with Mindbloom to offer members the premium version of the Life Game™ is one of the few efforts we found among payers that looks to engage the full spectrum of health of a member with a focus on Wellbeing.

Growing market in payers that can transition to a post-FFS world.

In the future, we predict that this market will continue growing along two distinct tracks:

- In payers that successfully transition their businesses to risk-sharing, care coordinating models (ACO/PCMH) looking to proactively engage members/patients in self-managing their health; and

- As pure marketing-plays, e.g. releasing cool mobile Apps that generate a nice press release, some market buzz, but little else.

As many readers may know, the health insurance industry is going through a period of rapid transformation. Payers with the means and the wherewithal to innovate their business models are purchasing providers, as well as partnering with them for data-sharing agreements and ACO-like payment contracts. Some large payers are also getting into the ACO-enablement business through acquisition of software companies.

Insurers who do not innovate their business models towards a post-FFS (fee for service) world (be they pure insurance providers or mostly claims processors) will find little incentive to experiment heavily with emerging consumer technologies. The crux of the matter is that they will never have the long-term incentives (nor the culture) to shift gears away from their actuarial focus and will remain low margin businesses, if they manage to survive at all.

Affecting behavior change towards health and wellness has proven incredibly difficult over the long haul. There is scant evidence that these new payer initiatives that seek to adopt common consumer engagement technologies and strategies are meeting objectives. As the entire healthcare industry pivots towards new bundled care reimbursement models though, there may be a glimmer of hope. I remain cautiously optimistic to see payers experimenting with and adopting emerging consumer technologies, knowing that there is still a long road to travel.

Excellent assessment John/Cora!

Truly a dynamic time for healthcare in the US!

A couple of wildcards are

-How effective will Health Systems be at developing the solutions for themselves and will they be willing to sell these services to other non-competing Health Systems?

-Will standalone HealthIT/Healthcare Service organizations be able to create & bundle the needed services & sell them directly to consumers, providers & payers?

All we know for sure is that the range of solutions is vast & anyone can be a winner or loser…

What a great time to be in Healthcare!

Paulo Machado

@pjmachado

Paulo.

Yes, I wonder if as health systems merge they will get into the ACO-enablement space along with payers — from the patient engagement perspective.

One current example is KP’s Avivia Health business unit that offers employee wellness solutions (though KP is definitely a one-off case).