Overview

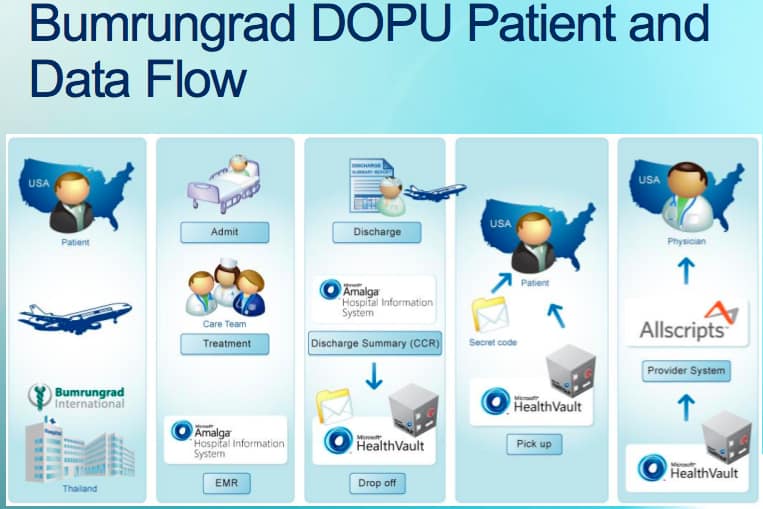

Currently, Microsoft has had discussions with some 28 countries to date on how the HealthVault platform might be used to serve their citizens. Of these 28, Microsoft has had more detailed,”scenario-based” discussions (specific use case scenarios, e.g. chronic care mgmt) with 11 countries and is in deep “contract-like” discussions with 6 countries. Microsoft is seeing the greatest interest from European and some Asian countries. In addition to these 28, Canadian telecom, Telus, will be the “Go to Market” (GTM) partner for HealthVault in Canada and Thai medical tourism destination, Bumrungrad Hospital will use HealthVault as part of a continuity of care process (see figure – DOPU stands for Drop-off, Pick-up) for US citizens. (Today, Bumrungrad serves roughly 60,000 US citizens/yr. Technically, Bumrungrad is not an international instance of HealthVault, although they did present in the International session. Bumrungrad is simply creating a HealthVault account for the US citizen on the US instance of HealthVault – there is no separate instance of HealthVault in Thailand.)

The key driver for all countries is not much different than what we are experiencing in the US. All are looking to reduce their medical risk profile by providing citizens and physicians better tools to manage health. Primary objectives include:

- Support telemedicine with device connectivity (HealthVault Connection Center).

- Provide mechanisms/systems/tools, via HealthVault, to allow citizens to better self-manage and where possible minimize chronic diseases.

- Proactively engage citizens in their health by providing them with access to their personal health information leading to better, healthier and more knowledgeable decisions and subsequently, behaviors.

For example, Finland currently has 90% of its physicians using an EMR, but like most countries Finland continues to see healthcare costs rise. Therefore, Finland is now looking at HealthVault as a critical component to take their national healthcare system to another level with deeper, direct engagement of their citizens and thereby mitigate cost increases. (In theory this makes sense, but there is no conclusive evidence that indeed this will work. Today, most are going on faith.)

The Business Model

As in the case of Telus, Microsoft intends to sell the HealthVault stack to a GTM partner in a given country. The GTM partner will typically be a private entity, such as Telus, but Microsoft does not rule out the possibility that a government entity may also take on this responsibility (likely rare). It will then be the GTM partner’s responsibility to build the localization of HealthVault substantiation in their country that is in compliance with the country’s (and sponsor’s) policies, laws (privacy, security, consent, etc.), standards, language, culture and other requirements that are pertinent. Obviously, it will also be the responsibility of the GTM partner to “sell” the platform to the sponsor (most often a government entity) and maintain the platform over time (maintenance upgrades, etc.).

Microsoft envisions the sponsor being directly responsible for defining the objectives of the HealthVault platform instance in their country. Therefore, the sponsor will identify what specific attributes of the platform to emphasize and identify the partners (software & biometric devices) that will comprise the ecosystem of services to be offered to their citizenship.

Actual pricing model for HealthVault appears to be in a state of flux as Microsoft seeks to better understand what is most acceptable in what is still an extremely immature market.

Some Technical Challenges

There are a couple of key challenges for Microsoft and its GTM partners as it looks to propagate multiple instances of HealthVault around the globe. They are:

- How to build in localization features without altering the core functionality (data model, authentication, APIs) that comprise the HealthVault platform?

- How to insure that all instances of the HealthVault platform are maintained as new features and functions are added to the core?

Sean Nolan, chief architect for HealthVault, outlined their strategy as follows: First, HealthVault’s architecture has two levels, one operational, the other policy. The operational level includes the core features (APIs, SDK, data model, etc.) that will remain common to all HealthVault instances – these are not altered in anyway by the GTM partner or the HealthVault sponsor in a given country. (Chilmark is assuming that within the “operational level” Microsoft will also enable support for various standards used in other countries.) It is at the policy level that HealthVault provides flexibility for country-specific modifications to be made (e.g., consent, record sharing, etc.). Sean did go on to say that to date, the HealthVault model for authorization is globally acceptable.

To address the second challenge, Microsoft has language in its contract(s) with the GTM partner that their instance of the HealthVault platform must be updated every 6 months. Currently, Microsoft updates HealthVault with new features/functions/fixes every 6 weeks or so. Going forward, it will be releasing to clients platform upgrades on a quarterly basis. Therefore, a given GTM partner and their sponsor can skip no more than one upgrade cycle. This insures that all instances of HealthVault fall no farther than six months behind, thus staying current with new releases, fixes, API enhancements, etc. This is extremely important as all these scattered instances of HealthVault could become nearly impossible to support. Maybe even more importantly though is that multiple instances at varying levels of version cycles could endanger the attractiveness of HealthVault as a development platform for third party software developers and device manufacturers who add value, via the ecosystem effects of this cloud-based platform.

Assessment

As we have outlined in previous posts, Microsoft is developing a number of models to monetize the HealthVault platform, going international being one of them. This is not too surprising as no one has figured out a direct to consumer model for a healthcare platform. The only who has come close is WebMD, who is heavily dependent on pharma for advertising revenue, and WebMD is a closed platform, not the more open ecosystem that HealthVault is becoming. Microsoft’s international strategy appears well-thought through and the architecture is in place to go abroad. It also appears that there is a ready market for this solution as virtually every country is struggling with some aspect of trying to control healthcare costs by lowering the medical risk profile of their population.

In moving into the international market, Microsoft is also creating far more opportunities for its ecosystem partners. Among its software and device partners, we project that device partners will be the biggest beneficiaries in the near-term as most are already international companies and have the distribution network in place to take their products to market. Software partners, of which most are small, typically build solutions to serve their markets of origin. Some of these companies will successfully move into international instances of HealthVault, but most will not.

But there may be some potential problems ahead.

First, it is not clear whether or not Microsoft will GTM in a given country with only one partner. For example, if the larger Infoway in Canada where to approach Microsoft tomorrow, would Microsoft also establish a relationship with them and let Telus and Infoway fight it out in Canada for garnering sponsor(s)? Certainly plausible but may also create conflicts that will come back to haunt Microsoft. (Received feedback from MSFT-HSG on this issue, their answer: in this scenario, they would allow Telus to sub-license HealthVault within Canada.)

Secondly, in all likelihood, GTM partners, acting on behalf of sponsors will make requests for platform features to add to core HealthVault functionality (operational level). Question is, how will these requests be prioritized and acted upon? The likely prioritization path will be similar to any large enterprise platform; poll other clients, assessed internal development goals and resources and make a go/no go decision. That is fine, but there will always be some clients who will want some level of customization/flexibility but it does not appear that such will be supported.

Another area where there may be an issue is on the policy front. Microsoft is a strong supporter of consumer rights to gain access and control their personal health information (PHI) and was one of the lead endorsers to the Declaration of Health Data Rights released Monday night. But what if some country does not share these views, e.g., Google’s struggles with China? What if a country does not support this basic tenet of HealthVault, consumer access and control? Will Microsoft refuse to do business with such a country/partner? Also, what fail-safes are in place to insure that GTM partners do not abuse/compromise the rich PHI data that they are collecting in a given country? Will that issue be left to the country where the instance is in place to address or will Microsoft exert some level of policy control via its contractural language? A slippery slope indeed.

Lastly, we still do not have clear evidence that giving consumers access to their PHI actually modifies behaviors leading to lower medical risk profiles. Yes, there have been a few studies of modest size that provide some andectotal evidence that such is the case, but honestly, the data is still pretty sparse. We are operating more on faith here than clinical evidence and while Microsoft appears to be off to a good start, it remains to be seen just how much traction they will get longer-term.

The issue you raise in your last paragraphs is exactly the reason why ICMCC had the guideline on Record Access sent to the WHO. However, it needs the national delegations to see to it that the guideline is put on the WHO assembly agenda.

Is there a way to alert the US national delegation. Similar moves are being made in other countries.

It would be brilliant to get the US delegation behind such an effort but as a relative newbie to this market, I am not sure how such would be accomplished. Here in the States, healthcare is an extremely politically charged environment. In fact, read this morning that lobbyist from the healthcare sector will spend some $500M in 2009 to promote their agenda. The only way to counter such influence is an uprising by the public, a literal storming of the healthcare Bastille.