TELUS and Microsoft have signed a multi-year agreement whereby Telus will license and host the HealthVault platform on their servers in Canada. Actually terms and conditions of agreement were not shared.

TELUS will call the service TELUS Health Space, which will have both English and French interfaces to serve the entire Canadian market.

Substantiation of HealthVault by TELUS will be done to meet Canada’s own rules and requirements for storage and sharing of personal health records.

The APIs that Microsoft has developed for their software and device partners will remain the same thereby allowing these partners to expand their presence/opportunities into a new market.

TELUS business model for Health Space will be to sell services provided by Health Space to individual provinces and territories who each have their own eHealth strategy. For example, Ontario Province is in the process of putting out an RFP for a Diabetes Registry. TELUS will position Health Space as an ideal platform to host such a registry service. Telus also intends to target payers and wellness service providers. Surprisingly, TELUS did not mention the employer market, but they may simply be a result of a nationalized healthcare system.

Go live for TELUS Health Space is anticipated for early 2010.

Microsoft Amalga will not be part of the deal as Telus has a competing product, OACIS, which will be integrated to TELUS Health Space. (Correction: comment from Microsoft states that integration to OACIS as well as Amalga is part of the deal.)

Background on TELUS

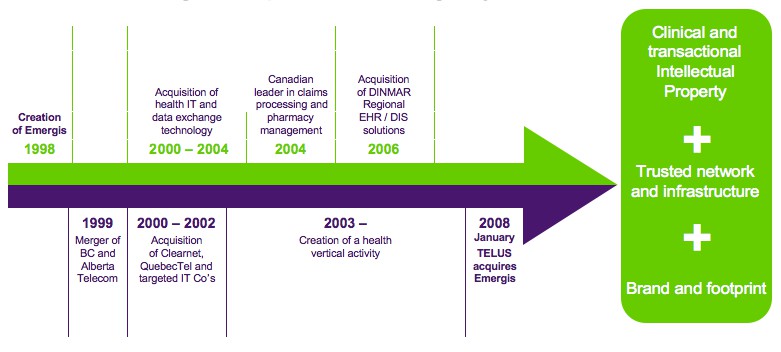

TELUS is no stranger to healthcare in Canada and has been on a course to build a significant services offering in this sector, most recently with the acquisition of EMR vendor Emergis for ~$768M. With that acquisition, TELUS became the largest HIT vendor in Canada ad some 5M Canadians now have an eRecord on a TELUS solution. The company is also a big player in pharmacy transactions and some 3,000 pharmacies in Canada use TELUS pharmacy management software.

Clearly this company sees an enormous opportunity to become the backbone of the HIT infrastructure for all of Canada, the addition of HealthVault to that portfolio gives them a strong hand on the increasingly important consumer eHealth side of the equation. Coupling HealthVault capabilities and ecosystem partners to Health Space and leveraging existing telehealth capabilities puts TELUS in a unique position within its well defined national market.

Implications

In the past couple of months, Microsoft partners have made some pretty powerful announcements regarding HealthVault:

New York Presbyterian’s use of HealthVault and Amalga for MyNYP.org demonstrates HealthVault’s move in to the provider market.

Mayo Clinic’s announcement of Health Manager for HealthVault is a combination of EmbodyHealth (a Mayo health content services solution sold to institutions and employers) with HealthVault repository that may prove attractive in the employer market competing with the likes of WebMD.

Announcement by TELUS to take HealthVault over the border and substantiate it in a new country. This announcement opens up a whole new world of possibilities on the international stage for HealthVault.

This last announcement clearly sets the stage for Microsoft to not only attempt to serve both the provider and employer markets, but also the international market by allowing the outright and complete substantiation of the HealthVault platform in a foreign country and leave it to the partner to insure substantiation of HealthVault complies with local regulations and policies.

Might we see a HealthVault in the UK that leverages the billions the NHS has already spent to digitize the healthcare sector? Might we also see HealthVault substantiations in other countries with high medical tourism offerings that not only meet the need of the indigenous population, but allows medical tourists to have after treatment their records uploaded to the local country substantiation of HealthVault and can later transfer those records to their home country’s HealthVault account?

At this juncture, it is hard to find anyone who is on the same level as Microsoft in addressing the consumer eHealth sector. WebMD is certainly there but based on their Q1’08 earnings released yesterday, their eHealth platform for employers and payers is seeing anemic growth of 5%. With little new coming out of WebMD, Google Health still seemingly lost, Dossia (who are they?) a bit of an enigma, and EMR vendors chasing ARRA funding, Microsoft appears to be the only game in town.

Big opportunity for Microsoft, but also one with big risks. They are highly visible now, not that they weren’t previously, but now they have to deliver. All of these announcements have a long-term horizon as to demonstrating their true value and Microsoft will need to be extremely diligent in its execution with these partners.

And while certainly this move by Microsoft is an interesting one, let’s not lose sight of what TELUS is quietly doing in healthcare.

With an existing robust communication system in place, TELUS is layering various healthcare services and technologies on top knowing that the demographics are in their favor that in time, care for baby boomers will increasingly take place in the home, there are simply not enough hospitals, not enough beds. Moving digital data is what telecoms do best and of course where they make their money. Healthcare will increasingly be awash in digital data as we move to not only get records into a digital format, ala EMRs, we increasingly will use mesh sensor networks to monitor health, as needed, remotely. Clearly, TELUS sees the writing on the wall and is putting the key pieces in place to fully capitalize on this opportunity.

Quoting their CEO Darren Entwistle:

…health care is the biggest single industry opportunity that awaits TELUS.

John – just a point of clarification – TELUS Health Space will support a connection to both Amalga and OACIS. Although not part of this licensing deal, we have provided for integration of both TELUS and Microsoft clinical systems and technologies within our agreement.