This past week I attended the annual J.P. Morgan Healthcare Conference, and the multitude of satellite events surrounding it, which attracts about 40,000 people from across the industry. It is where the business of health occurs, where money (Wall Street, PEs, VCs) looks to make a deal with just about any business in healthcare (life sciences, medtech, hospital systems, payers, start-ups, etc).

This past week I attended the annual J.P. Morgan Healthcare Conference, and the multitude of satellite events surrounding it, which attracts about 40,000 people from across the industry. It is where the business of health occurs, where money (Wall Street, PEs, VCs) looks to make a deal with just about any business in healthcare (life sciences, medtech, hospital systems, payers, start-ups, etc).

It’s a fascinating event to attend and arguably one of the best for getting a broad read on the entire healthcare sector and its future trajectory. Following are 8 significant takeaways:

Loud noises, but steady hand at the tiller. A lot of political “fire and fury” came out of Washington in 2017 regarding the Affordable Care Act, but despite several attempts ACA repeal did not occur. Political noise may continue to spout from Pennsylvania Avenue – but over at HHS, new leadership will quickly get down to business, proceeding with value-based care initiatives. The latest example: CMS’s reinstatement of rules for voluntary bundles as an APM under MACRA.

Medicaid in stormy seas. While CMS stabilizes Medicare, state-run Medicaid programs will see turmoil. As of this writing, CHIP remains unfunded, and Medicaid funds distributed via state designated health programs under 1115 waivers will evaporate. This will impact many states significantly, as healthcare costs are already a leading line item in their budgets – nearly 40% in our home state of Massachusetts. How states address this federal shortfall bears close watching.

Cost consciousness arises. The transition to value-based care (VBC), contractions in CMS spend and likely increase in uncompensated care will force healthcare organization (HCOs) to take a hard, deep look at costs. Administrative and supply chain costs will be primary targets. As a corollary, this cost consciousness extends to health IT. If your solution does not deliver a clear ROI in a year or less, you will get the brush-off.

New breed of CIO. The majority of CIOs that oversaw go-lives of enterprise EHRs over the last decade are not likely to be the ones to drive their HCO’s digital health strategy going forward. A new breed of CIO is on the rise: One with a combination of clinical, business, informatics, and IT skills. They intuitively understand the operational and strategic value of IT in both a clinical and business context.

Tax reform accelerates M&A. Recent passage of the tax reform bill brings fresh cash into the coffers of businesses. This cash influx will be leveraged to drive further consolidation rippling across all sectors of the healthcare market. The proliferation of start-up health IT companies with few exit options will lead to rapid consolidation as larger companies leverage cash for strategic fold-in acquisitions.

Next generation of start-ups emerge. I spent some time at the Startup Health Festival to hear many a pitch from young start-ups. Instead of conversations on how to disrupt or transform healthcare, which were the norm a couple of years back, conversations this year addressed a specific issue or problem in the healthcare system. These companies demonstrate a deeper level of understanding of healthcare than years past – typically on how they will provide a “tech-enabled service.”

There’s gold in removing administrative burden. From physician burnout to increasing expenses, administrative friction creates a huge burden across this sector. HCOs will increasingly look for solutions that minimize this burden. During a panel I moderated on Blockchain, the panel was unanimous: Blockchain, in conjunction with cloud computing and smart contracts, shows significant promise of removing administrative friction in provider-payer interactions.

Blockchain is coming, and coming fast – but it will not be widely deployed until ~2022. More near-term is the use of AI/ML to optimize and automate administrative activities. I spoke with several companies, typically at Series A funding level, which have already gained significant wins in relatively short order. This is one area to watch closely in 2018; growth in demand for these solutions will ramp up significantly.

The Fury

The Fury

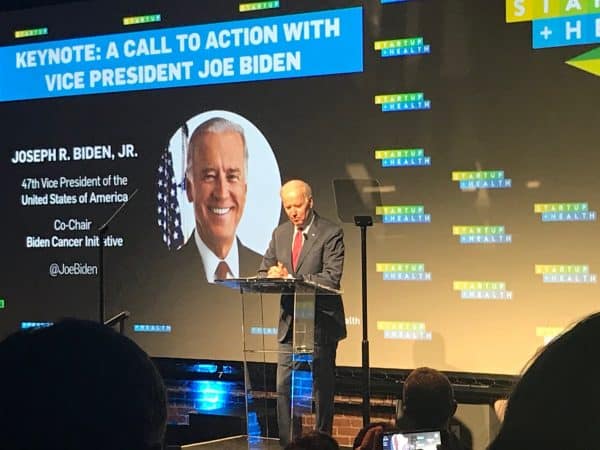

Vice President Joe Biden spoke at the Startup Festival, reflecting on his son Beau’s death due to cancer. Biden spoke passionately to the crowd about the Cancer Moonshot initiative and the dire need to change the current system of health in this country.

He did not mince words.

Biden implored the audience to dedicate themselves to improving healthcare delivery and persist until they get it done. But Biden also deplored the industry for failing to deliver, after $38B in federal investment, a digitized healthcare system with data liquidity at its core. Unlike most, who readily level this charge at vendors, Biden placed blame squarely on HCOs, which is not unfounded.

Will FHIR come to the rescue in 2018? Unlikely in any significant degree, as we wrote in our 2018 Healthcare IT market predictions, outside of clearly defined clinically integrated networks.

The Flurry

It is clear that the flurry of activity that concluded 2017 (Optum-DaVita, CVS-Aetna, Providence-Ascension, Dignity-CHI, Advocate-Aurora, Humana-Kindred) will not subside anytime soon. 2018 will be yet another year of significant consolidation as the entire industry grapples with tighter margins and the need to migrate from tertiary, system-centric care to preventive, consumer-driven care.

What are “administrative activities”? How are AI/ML impacting them?

Administrative activities are many ranging from creating quality score reports that are self-validated and trusted by payer thus not requiring onsite chart pulls to referral mgmt processes, eligibility checking and prior authorizations. And I’ve only just scratched the surface…

Great write up of the event John!

And there is certainly a LOT of GOLD to be removed from the “Burden Hills”- whether it is administrative or even routine clinical care… there is a lot of staff a computer can do faster, cheaper, and usually better than an MD (a good piece of HIT software can do routine work based on protocol, and never forgets to document, nor fails to document well).

That was the foundation for healthfinch… how can we make life easier for docs and better for patients at the same time… if we can do that – there must be gold!

Well it took a bit longer than we wanted, and involved a lot of major integration with some EMR Vendors… but it works! healthfinch saved over 30 million minutes of Physician time in the last year alone!

Here is a great Case Study to show what it can look like at scale – using automation to handle refill request, saving >$1M in cost while saving docs a few hours a week

http://info.healthfinch.com/download-osf-case-study