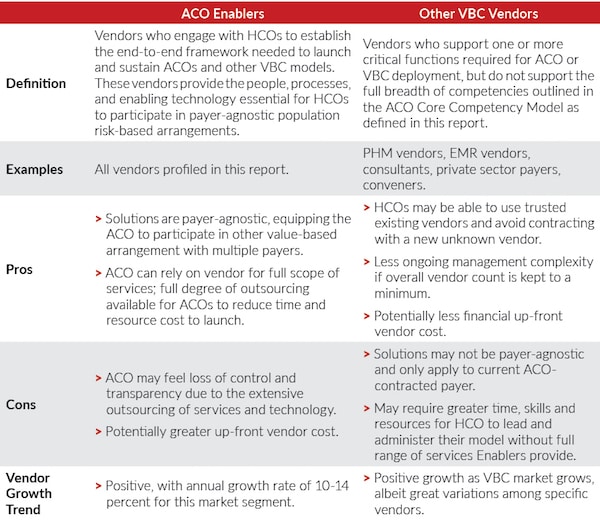

Successfully enabling an Accountable Care Organization is extremely challenging: There isn’t one standard ACO model; there isn’t one single ACO national policy; there isn’t one specific map to follow to build an ACO nor measure its success. There are few if any best practices readily available for healthcare organizations to adopt and make a successful transition to value-based care (VBC) within an ACO model. This has created a strong market need for high-service solution vendors (“ACO Enablers”) that can guide healthcare organizations (HCOs) on the ACO path.

Despite the complexity of the ACO model, ACO growth has climbed steadily since 2012, with over 1,300 ACO contracts now executed in the U.S. Yet this VBC model is by no means mainstream, covering only 10% of the U.S. population. Despite this relatively small number, our in-depth research uncovered a market that is far from plateauing and will see accelerated growth as both commercial and government payers look to ACO models of care as key to their efforts to rein in costs while improving quality and access to care.

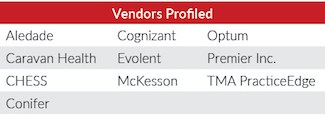

In the latest report from Chilmark Research, Reducing the Risk: Vendors Enabling the ACO, we identify key components and requirements of at-risk providers and ACOs, including a discussion of ACO market growth and historical challenges encountered. The report discusses assessment criteria and guidance on the technology requirements and hurdles faced by ACOs, then takes a detailed look at the 10 specific vendors selling full ACO enablement solutions. It concludes with projections of the future market trajectory, as well as recommendations for both ACOs and the Enabler vendor niche.

The technology components that ACO Enablers offer run the full spectrum to fit the market segment served. Each profiled vendor has purpose-built or acquired its own technology –with the exception of three vendors who outsource or partner for EDW, analytics, and care management software. This observation from the Chief Technology Officer of one of the profiled ACO Enablers, TMAPracticeEdge, succinctly summarizes the technology conundrum facing many fledgling ACOs:

Some ACOs initially think that they can handle the technology requirements of their organization by themselves. They may have started with a fairly simple payer product and it all looks doable. But, as they expand their product portfolio and start moving towards risk they realize that they need a much more sophisticated capability to perform well. At that point, they have already invested some money in tools and people so they are torn between starting over with a vendor partner who can leverage a robust existing platform or continuing to try and develop it themselves.

We are likely to see additional M&A activity in the Enabler vendor niche in 2017 and 2018 as we did in 2016, with Evolent’s acquisition of Valence Health, as the VBC vendor market consolidates to increase market share, capabilities, and clout with HCOs in a given region(s). One particular natural alliance would be for an EHR vendor and Enabler (or business entity within an Enabler organization) to join forces, to increase ease of data sharing and integration and to offer a more complete solution portfolio that includes all PHM components. Another natural partnership will be for payers to join forces with Enablers to support new ACO launches as well as the critical task of optimizing existing payer contracts.

The Enabler vendor niche serves a broad function in the industry by lobbying with the Centers for Medicare and Medicaid Services and partnering with both CMS and commercial payers to help determine the future direction of VBC models. While we have defined and profiled these vendors as they sit today, the market is rapidly changing and these vendors are changing with it. We will closely follow this market sub-segment as value-based care continues to evolve.

0 Comments