The federal largesse of the HITECH Act is basically over. At ONC’s annual meeting last week, they trumpeted the latest adoption figures, which basically point to a saturated acute care market. The ambulatory market while less penetrated, has not shown significant signs of robust growth in the past year as well.

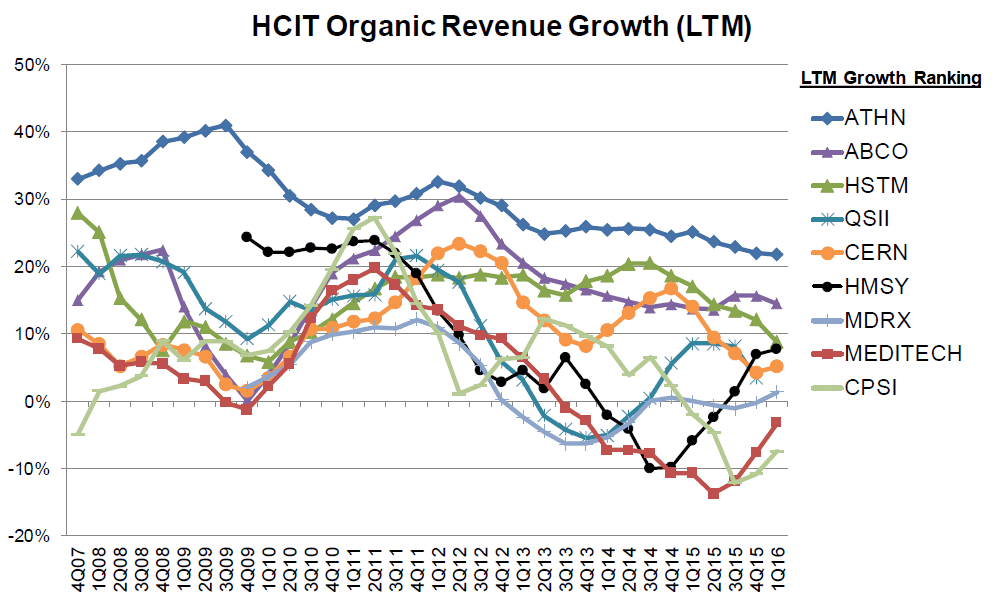

Everyone saw this coming and most EHR vendors stated that there was plenty of runway left as there would be a robust replacement market on the order of 30%+. Well that has not materialized either in any significant fashion. The only replacement market happening is either replacement of sun setting products (Siemens or McKesson’s Horizon), or via M&A activity and a forced migration to the parent/acquirer’s system. As a result, almost all of the publicly-traded health IT companies as a result have seen a reduction or stagnation in their organic growth rates since the start of 2015.

Instead we have seen a shift in capital investment among providers increasing their level of investment on facilities-oriented projects (upgrading physical plant or building new facilities) along with increasing investments in neglected areas the past few years including imaging.

Source: Robert Baird

In the ambulatory EHR market, Cerner’s replacement win with Dignity Health is the largest outpatient announcement year-to-date. But here again, this is just an extension of Cerner, they already are well entrenched at Dignity in the acute arena. It is a bit harder to accurately gauge replacement activity in this market given its much more diffuse nature but our conversations with vendors also indicate relatively tepid replacement activity too. Physicians had enough trouble trying to attest to Stage 2 MU and generally seem to be in no rush to adopt yet another new EHR solution unless it forced upon them.

To sustain growth and keep investors happy, EHR vendors have had to pivot, and in a big way towards revenue cycle management (RCM) services and population health management (PHM) (2018 Update: Read our latest analysis of the results of this pivot). While RCM is certainly important to a HCO’s bottom-line, it is not going to move the needle on the healthcare delivery chain. Instead, what we have been looking for are signs of an uptick in in the broadly-defined ‘population health IT’ spending category, which we find far more interesting and arguably, far more lucrative long-term. Based on this most recent quarter of earnings calls, there are signs that population IT spending is starting to pick up, but don’t go cashing out just yet – we have a long ways to go.

Announced Population Health Deals (Most Recent Earnings Call)

The acceleration of value-based reimbursements and at risk revenue models for providers is finally starting to provide the spark to create more meaningful RFP activity in the Population Health IT space and the inkling of some meaningfully-sized deals. We do not expect any needle moving revenues to be generated until late 2017 and into 2018 in this space given the less capital intensive, SaaS-based pricing of the Population Health IT products being marketed and developed along with the ‘pilot’ nature in which these solutions are being utilized often with less often with than <100k lives.

However, it is apparent based upon in our conversations with buyers of these solutions that what was a punchline set of products as little as six months ago is starting to gaining significant attention even if the requirements and vendor solutions remained quite varied. And therein lies the rub.

Just about everyone in the HIT market today claims to now be a PHM solution vendor. At this year’s HIMSS we even saw Rubbermaid proclaim in its booth that it to was a PHM vendor. Rubbermaid? Seriously, what are they smoking?

While just about everyone will discount Rubbermaid’s claims, there remain an exceedingly wide array of competent vendors in the PHM realm. They will unlikely have everything needed to enable a full PHM strategy, but enough to get an HCO started. This is creating a heightened competitive market that will put pressure on incumbent EHR vendors, who have the inside track, to up their game being competitive on price and functionality.

End result, while HCOs try to stabilize their IT initiatives, rationalize their vendors and move forward, the vendor side of the equation will see increasing instability as merger and acquisition activity increases. In our most recent PHM engagements with providers the overriding concern is risk aversion i.e., help us select a vendor who will be there for us long-term. Will you be one of them?

0 Comments