I’m here at the big JP Morgan conference in San Francisco where CMS administrator, Andy Slavitt dropped the bomb that the Meaningful Use

This really comes as no surprise, at least not to this analyst (we called for this in a post in mid-2014).

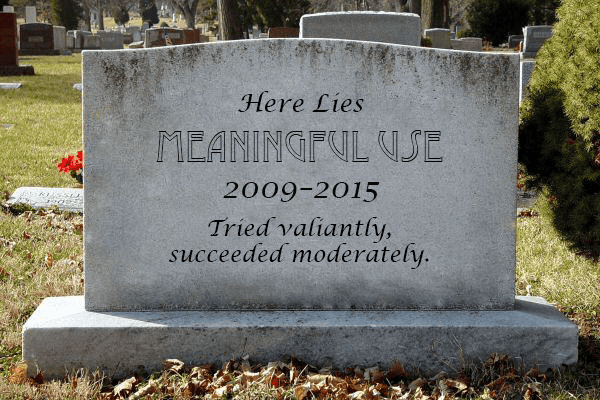

Meaningful Use had accomplished its primary goal of getting providers to adopt EHRs and begin digitizing patient information. While we have not seen a tremendous amount of value out of this digitization effort yet, I am confident that it will come.

But MU went astray in becoming far too prescriptive and innovation, at least in the EHR space, came to a standstill. Nearly all development resources at EHR vendors went to meeting the MU certification criteria. On the provider side, frustration arose in having to meet attestation requirements that had no apparent relevance in the delivery of quality care.

Now it is time to move on and in moving on, the death of the MU program will have three big implications to the market.

- We will see rapid consolidation in the ambulatory EHR market. The HITECH Act, which spawned MU created a false market and countless EHR vendors entered. No Ambulatory EHR vendor has more than 10% of the market. The market has also by and large plateaued in the US, which will put a strain on most EHR vendors. A company with deep pockets will begin rolling up the best of the bunch. Look to what Infor did in the ERP market to understand the overarching strategy – same will occur here in the healthcare sector.

- Financially healthy EHR vendors will invest more on innovation. Now that EHR certification requirements are no more, or at least no more Stage 3, companies will have the extra resources to get back to providing true innovation in the market. Expect more innovative models for capturing and sharing PHI going forward and vendors doubling down on their PHM initiatives. P.S., certification organizations will fade into history.

- The move to MIPS creates some big opportunities for new solutions. Provider cheering of the demise of MU will be short-lived as CMS still has a big ask of providers tucked into MIPS. The upside and potential penalties folded into MIPS represent a 14% swing in potential CMS reimbursement. Providers big and small will seek-out solutions that mitigate the risk and optimize the upside. A lot of details tucked into MIPS that solution vendors will need to tease out and solve to serve their respective market(s).

A lot to digest here and while Slavitt’s comments were telling, they were also thin on the details. Chilmark Research will be digging deeper into this issue in the upcoming weeks. Stay tuned.

And finally the focus is now on outcomes, its prerequisite interoperability, and stigmatizing information blocking. We advocated for all of this in 2007 when Meaningful Use was being conceived, knowing fully well how the industry’s general response would be “lipstick on a pig” and “what information blocking?”

Billions, and a whole lot of mind numbing “just get me the check off I don’t care about whether anyone uses it” conversations later…

Realistically, or course, this doesn’t mean the agendas will go away silently into the night … leaving us as individuals and patients to continue to live with the consequences.

Yes Sumit, we will live with the consequences for some time to come, but these consequences are not all bad – though some may easily argue the majority are.

I do remain hopeful that over time, we, as an industry, will learn how to extract value from these systems of record we are now using to capture personal health information. The trick going forward is how do we take that information, extract it effectively from the clutches of these legacy systems and actually do something truly useful to improve the health of a community – an area where you, I, and others are all devoting significant amounts of energy.

John,

Agree, this is a very important topic. There will be many consequences, some of which will be unintended and some of which won’t be obvious for a while. It’s worth putting our collective heads together to think it through.

Re: #1, more likely that the EHR market will consolidate due to vendors falling out, less so due to acquisitions.

One EHR vendors acquiring another is dicey; you still have to maintain the acquired co’s software — at least for a while. There’s also no guarantee that existing customers of the acquired co can be converted. Thus, there is no easy roll up strategy here.

Agree that no MU means more innovation, and that contributes to my point above. Vendors will better be able to differentiate themselves based on UI and customer driven enhancements. Less innovate vendors will fall by the wayside, not get acquired.

re: #3, again I agree…and let me add # 4 to your list. It’s worth noting that “no more MU” will have vastly different implications in the physician vs. hospital markets.

Many of the physician MU requirements likely will be picked up in the MIPS/MACRA regs — yet to be determined which ones.

Hospitals don’t have MIPS/MACRA regs to look forward to, so it’s more likely that a lot of MU required capabilities fade into the sunset, e.g., what happens when hospitals aren’t required to get health record data to 10% of their patients?

Hello Vince and good to hear from you.

In point one I made the distinction that viable EHR vendors will be acquired – agree with you that a fair number will fold.

However, acquisitions, if done right, can consolidate a market effectively as well and thus I believe it will be a mix of the two. What Infor and SSA did in the ERP market was quite savvy:

Acquire small ERP companies with an establish base

Tell these customers you will never sunset their product (only investing just enough development resources to keep up with specific regulatory needs and bug fixes).

Increase maintenance fees to cover costs and then some for the legacy software.

Slash all other expenses (especially SG&A).

Have a couple of core products that keep up with the times, both in UX, bells and whistles, etc. that offer an upgrade path going forward for when a customer finally decides to switch.

Any idea what this might mean for the Blue Button initiative? Or any initiative to make sure that patients have easy access to their own medical records & data.

Do not see this having a major impact on Blue Button or for that matter any pt. engagement activities, which to date have been modest. Stage 2 is firmly in place and Stage 2 MU does require providers to allow patients to view, download and transmit (VDT) their PHI. Also important to note that more broadly HHS will not tolerate providers who create barriers to patient access to their records. If anything, HHS will enforce this even further in the future and come down hard on providers who limit such access.

Finally we can get down to what matters. Meaningful Use as it ended up hindered providers from being EHR “Meaningful Users” and we can hopefully move away from what was best described on a sign I observed at last year’s HIMSS meeting…”Meaningfully Useless”.

Mike, that is truly our hope as well. Meaningful use went off the tracks awhile back and we have been advocating a different approach for over 18 months now. Thankfully, the powers that be are beginning to come to the realization that there are other ways to ensure meaningful use than draconian, prescriptive measures