After much speculation and mounting criticism of Meaningful Use (MU), two recent developments provided some clarity on the future direction of the program and indications of how rocky a road it will be for providers in stage 2.

Fleeting Relief

After a summer filled with mounting criticism and a litany of responses & comments on how to modify the program, CMS issued their much anticipated new final rule for Meaningful Use (MU) Stage 2 on August 29th. For providers who were hoping for some relief, they did not get much.

While providers have greater flexibility for 2014 in terms of using 2011 or 2014 certified EHR technology (CEHRT) to meet the 2013 or 2014 objectives and measures, many were critical CMS did not go far enough in relaxing the rules for 2015. In 2015, providers will be required to use 2014 CHERT and report for the full year (vs. only one quarter in calendar year 2014).

Making matters worse, this is based on the federal calendar year which begins Oct. 1, 2014. This leaves providers with little time to get their bright shiny CEHRT for stage 2, in operation, workflows mapped to support new guidelines (more eCQMs) and staff trained to insure the right metrics are collected for future attestation. It also continues to place a heavy burden on providers who are struggling with MU menu objectives that relies upon cooperation from third parties (e.g. patients, labs, post-acute providers) to meet threshold objectives.

Tepid Attestation – Will it Continue?

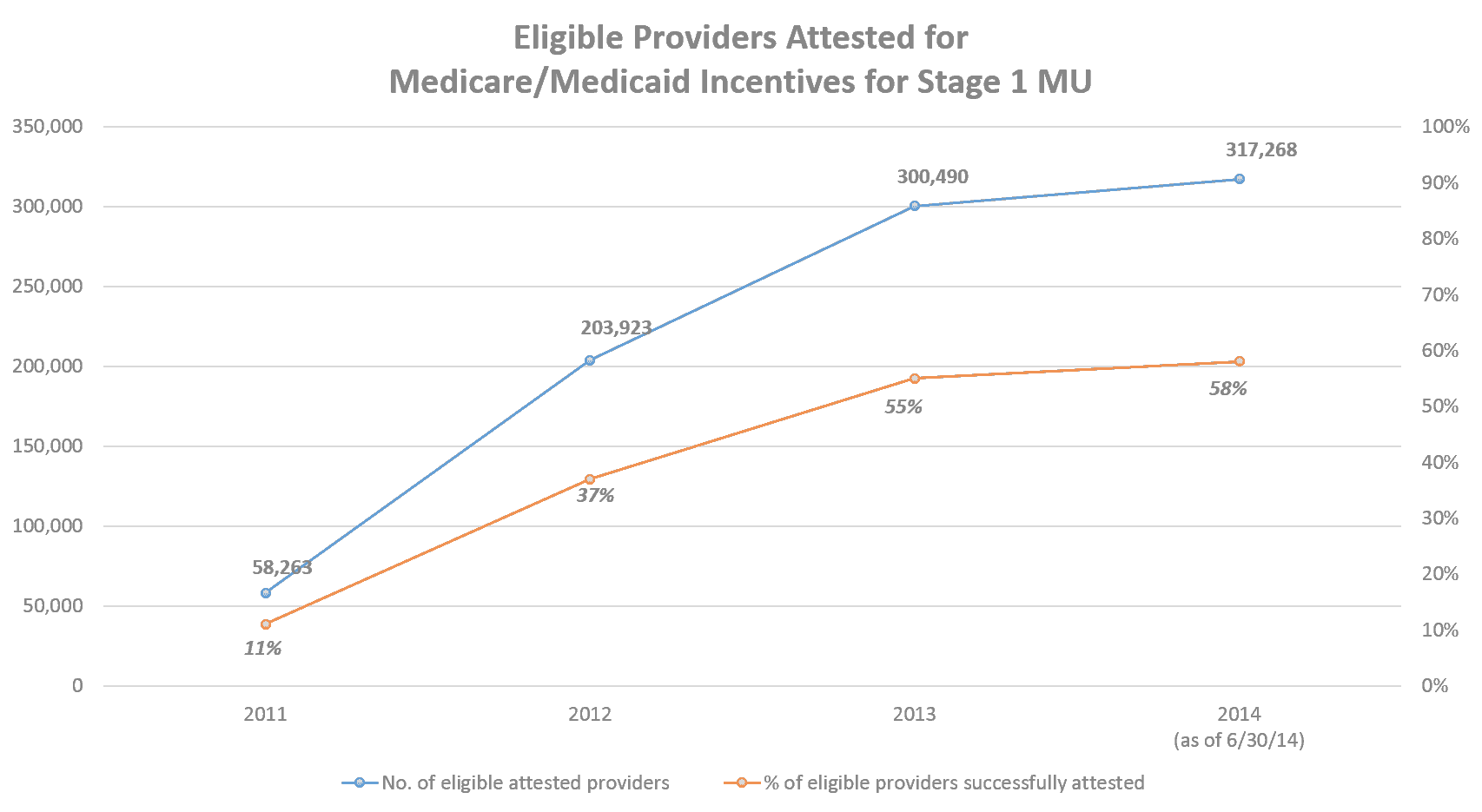

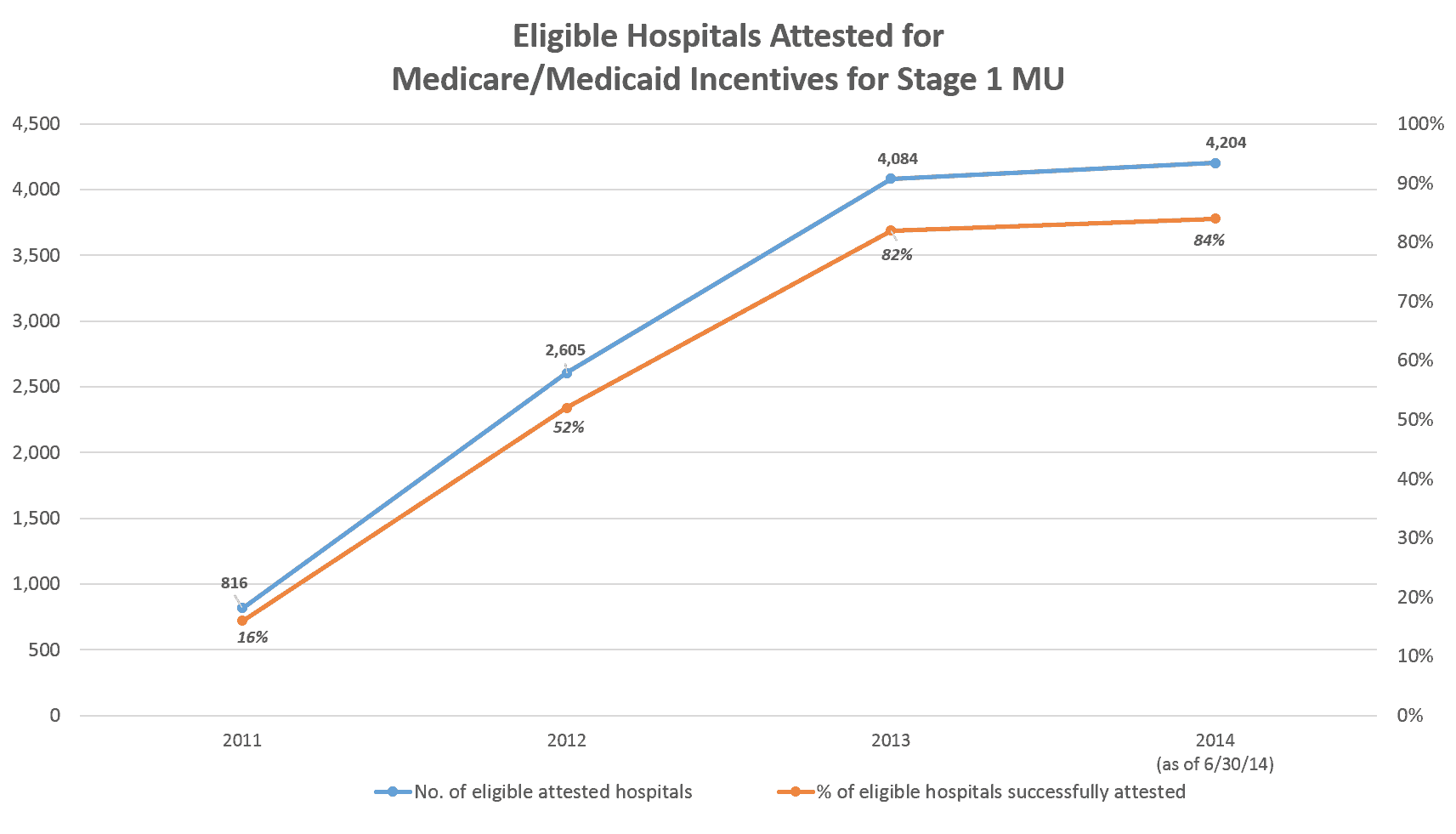

Last Wednesday’s HIT Policy Committee monthly meeting also provided an update on electronic MU attestations thus far in 2014. Year-to-date figures showed noted improvement since the last meeting in August but overall adoption of stage 2 remains lackluster.

Through August 25th, 8,024 (vs. 2,823 as of July 1) eligible professionals had attested for the 2014 reporting year with 3,152 (vs. 972 as of July 1) attesting for stage 2. For eligible hospitals, 436 (vs. 128 as of July 1) had attested for the 2014 reporting year with 143 (vs. 10 as of July 1) attesting for Stage 2.

To put that in perspective, only ~3.5% of hospitals of eligible hospitals and ~2.5% of eligible providers who have successfully attested for MU stage 1 have attested for stage 2 to date. As of this writing, an estimated 85% of all hospitals in the US have yet to meet stage 2 requirements. That is a very big percentage.

Cloudy Forecast for MU

From a payment perspective, MU is entering a period where penalties will potentially become larger for hospitals than incentive payments. The numbers disclosed at the monthly HIT Policy Committee meetings will be very important to monitor through January. If stage 2 attestations remain tepid, it will be an early indicator of waning provider motivation regarding stage 2 MU and likely the whole MU program.

Several key questions regarding MU also remain. What happens if the initial funds that were authorized by the HITECH Act are exhausted this year? What is the political will today in Congress to actually implement the penalty phase of MU? Will the rumors of stage 3 being permanently shelved if stage 2 attestation rates remain low through 2015 come true? Then there is always the issue with a pending change in the administration and just how much the next administration will continue to invest political capital in this program, which frankly has met its initial objective of driving the adoption and use of EHRs.

The net takeaway is that these particular MU announcements will have little real impact on providers or health IT vendors. Providers committed to stage 2 MU will continue to invest in solutions and services through 2015 in order to attest. Providers who have yet to upgrade or purchase 2014 CEHRT technology or are struggling with quality reporting and meeting menu objective thresholds will face a difficult decision:

Is it worth the time and capital to get on the stage 2 bandwagon or place the bet that future penalties for not meeting stage 2 requirements will be small if not non-existent?

Regardless of what a provider/HCO may decide, health IT vendors who offer CEHRT-related solutions, will have to remain committed to spending a significant amount of their R&D budgets on MU for the foreseeable future. Vendors who cannot meet this requirement will have to make some difficult strategic decisions over the next year including whether to exit the market entirely.

0 Comments