8:15am, Intro done, Matthew, founder with Indu of the Health 2.0 conference announce all the countries and cross-section of companies represented. Quite amazing just how many people are here, nearly 900, considering the first Health 2.0 event was just over a year ago.

Some very very general comments from Matthew on what Health 2.0 is. What he has added to his famous bubble chart is transactions and data – basically how large data holders (e.g., Aetna or Kaiser-Permanente) are now getting into the Health 2.0 space with their massive data stores contributing to the continuing evolution in this market.

A spokesperson from PR firm, Edelman, also got up on stage to announce the release of their recent consumer study, The Health Engagement Barometer Dimitriy wrote a nice overview of the report.

9:30am, Clay Shirky keynote. He is on a book tour of sorts with his recent publication of Here Comes Everyody”, transposing his findings to the healthcare industry. Shirky states that there is already a NHIN, if not an international HIN being driven by consumers who are actively sharing and collaborating around health issues. Trust is not an aspect of technology, but one of a personal human nature. Where there is trust, information will flow. (Excellent point, so much effort is spent on the issue of privacy and security with vendors all seeking technological solutions to the problem. Unfortunately, they are putting their efforts into the wrong thing. Are you listening Microsoft, Google, payers and employers?)

Patients outnumber physicians 100:1, it will be patients that will be at the heart of healthcare change. Patient care is now beginning to occur among patients themselves rather than with physicians in small, focused organized groups around specific diseases.

What Shirky plans to follow in the future is how institutions (gave the example of orthopedic company, Zimmer) will try to thwart the growth in Health 2.0/patient communities due to perceived threat from consumers (whether real or imagine is another story). Shirky sees these efforts as quixotic.

9:00am, David Kibbe’s motorcycle tour video is now showing. Kibbe basically went across the country mostly interviewing Health 2.0 vendors beginning in my home town of Boston speaking to AmericanWell and PatientsLikeMe. Next stop was Dr. Jay Parkinson’s start-up, Hello Health with some discussion on the IT platform they are using with their customers. Adopted a facebook-type model, a doctor with 1000 friends, who happen to be his/her customers. Kibbe also dropped into a retail, Minute Clinic in TN. (Kibbe seems to ask all those he interviews: “Are you Health 2.0?” – getting a bit annoying). Not much from Minute Clinic. Road-trip stopped short when Kibbe’s motorcycle broke-down in TN. Flew to CA to interview Google Health, Healthline (Healthline CEO is lots of consolidation coming and big players jumping in). The Healthline CEO looked like the best interview, too bad it was cut so short.

10:15am Panel Session – Consumer Aggregators With the exception of Dossia, all the big boys are here: Aetna, Google, Microsoft, WebMD and surprise, Yahoo. Haven’t heard much from Yahoo in a couple of years as it pertains to health, will be interesting to get their comments. Aetna spokesperson announced the partnership with HealthVault for data portability. Microsoft spoke of their growing platform rattling off the statistics of number of devices, number of apps, etc., but no numbers as to how many users! Google talked about how they are focused on just making it easy for consumers to access and use their record data. Yahoo Healt spokesperson s brand new to the position and is now building a new team. Announced a partnership with Waterfront Media (content) and Healthgrades (physician search).

Demos by panelists:

WebMD used the Verizon HealthZone. Claims data driven PHR with HRA and risk factor analysis (what WebMD calls Health Quotient). WebMD providing structured health content and will even provide health coaching if client requests it. Phil Marshall, VP Product Development at WebMD did the demo.

Microsoft had Kaiser-Permanente give the demo. KP showed how a KP MyHealthManager customer/user would move their records to HealthVault. Using HL7 CCD for transmitting the data between the two sites. KP has put together a fairly easy process (reminds me of the BIDMC/Google Health process) to move the records. Peter Neupert got up to give the HealthVault portion of the demo – he was unable to log-in to HealthVault to conduct the demo – OUCH!

Note: After reading this post, Sean Nolan, Chief Architect at HealthVault, put together a quick post on what Peter was trying to demo up there on stage. Not quite the same as a real life demo, but Sean is able to show and describe the steps of importing records from the Kaiser system into HealthVault.

Next up was Aetna. Unlike Neupert, he quickly logged in to the Aetna PHR. Thy now have ten active health trackers in the PHR, online coaching and of course, the Care-Engine rules engine for alerting consumers on risks. They put out over 1 million alerts to PHR members/qtr. Healthline Looking at having all 17M covered members on the PHR by the end of 2009. Currently have 6M members on the PHR and forecast 7M by end of year.

10:50am, Here comes Google: Did a demo on downloading medications from a pharmacy into a consumers Google Health account. Geez, this is boring – retty basic, unimpressive demo. Hell, they had this capability when they first rolled out Google Health, would think they would actually show something new and interesting. Another demo glitch. Pharmacy partner doing the demo got hung-up had to go into the depths of the app to make it work, something no consumer would take on. Another poor demo.

Microsoft is given another chance, again demo fails. DOUBLE OUCH!

Last up, Yahoo Health. Kerry Hicks, CEO of HealthGrades is intro’ing the demo and Michael Yang of Yahoo is not so much giving a demo, but an overview of the interface/GUI of Yahoo Health. Complete redesign beginning with physician search (embedded HealthGrades app/service). Claims Yahoo is good at data mash-ups, particularly for rating and reviewing and will apply that expertise to Yahoo Health. Will also leverage Yahoo Groups, have gateways between the various groups and Yahoo Health.

Q&A with Panel:

Aetna spends $60M a year answering physician calls regarding member eligibility. They see big savings via th PHR for members that will alleviate, if not eliminate these calls. Microsoft is not worried about the trst issue, like us here at Chilmark Research, believes that what really needs to be done is create value. Yahoo has no intention of getting into the PHR market. See themselves as a possible “swing vote” to bring visibility to the concpet without any vested interests to support one PHR or platform or another. See themselves as providing a rich environment for widgets, and add-on services to these other consumer aggregators.

Couple of more data points from Aetna:

- Each 1% of members that move to having their EOB delivered electronically vs. snail mail represents a savings of $500K/yr.

- Each 1% of physicians that they can get to move to self-checking eligibility of customers online vs calling in saves Aetna $600k/yr.

No wonder they are investing heavily in eTools.

Kolodner, head of Dept of Health & Human Services ONC took the stage to provide his perspective on what was said by the consumer aggregators. Not sure if it is me or not, but why do so many govt. bureaucrats give such boring presentations. Kolodner did not use any slides, but oh it was hard to concentrate on what he was trying to say. In th end what I got out of it was, let’s not move to fast, let’s focus on interoperability, let’s insure that privacy and security are preserved. Looks to me like he was defending CCHIT and its consumer-facing initiatives.

1:00pm, Search in the Long Tail Panel Session: Matthew Holt has always been a big fan of health search tools for consumers and has brought together all the big, health-centric search companies, Healthline, Kosmix/RightHealth, Healia (which Meredith acquired), and Organized Wisdom. Not much new said in opening statements, typical positioning statements, boring.

Demos:

Healthline began, really hard to see much here that would attract me to the site. Actually, would probably avoid as it presented a barrage of “stuff” and I always look for nice clean interfaces. Guess Google has spoiled me.

Healia demo, by founder Tom Eng talked about the communities feature they brought to market this past summer. Clearly looking to tap the growing disease community market. Partnering with American Diabetes Assoc for a diabetes centric community.

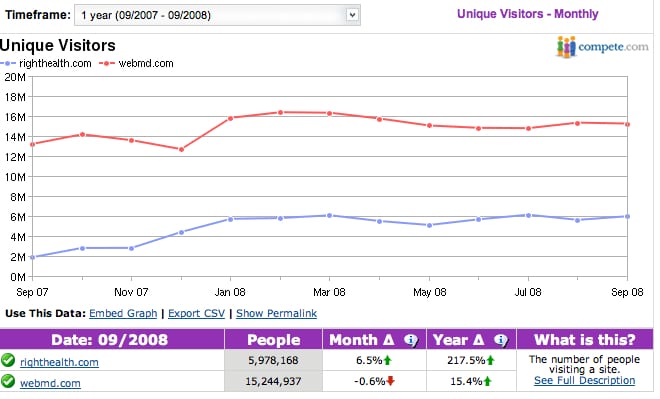

RightHealth (Kosmix) was next. One of the better demos and it appears that the broader public agrees as RightHealth claims to be the second most visited site after WebMD with 8.5M unique monthly visitors. Quick check shows something different. Yes, RightHealth has good presence, but in Sept. 08 it was only about 6M and WebMD is more than double that.

Last was Organized Wisdom. A lot of buzz, but leaves me wondering, Where’s the Beef? Of what I heard so far from these search providers, this company is probably in the most precarious position going forward. They did announce that they will be offering a physician rating/search service within Organized Wisdom. Now why do that instead of partner?

Healthline will also be looking to provide a physician search service. RightHealth will not, they will look to other, best-in-breed companies, to provide this service. Healia as no intention at this time to go down the physician search and rating path.

1:45pm Social Communities: Great line-up here with the CEO of Sermo, CEO of MedHelp, GM of HealthCentral and CEO of PatientsLikeMe (PLM). Sermo last year was at 40K physicians, they are now at 90K physicians. PLM is seeing very strong growth for their most recently introduced communities to address mood disorders (We had concerns as to whether or not PLM would scale effectively and mood disorders would be a real test, if not one of the hardest. Mood disorders are terribly challenging and terribly personal and there is a social stigma. PLM’s ability to overcome these challenges is true testament to the value they are delivering.) PLM is focused on addressing what treatments work in the real world for real consumers. See themselves becoming a key arbitrator of future pricing based on real efficacy.

Comments from HealthCentral and MedHelp have been pretty simplistic in comparison to comments by PLM and Sermo.

Demo-time:

Sermo leads off showing the power of community intelligence. Big question that they had to face was will physicians trust the site. Time and agin they have been able to demonstrate that the system does work. This is contributing to the viral-like growth of Sermo. Which makes me wonder, just how many of those docs on their site are from the US vs rest of world? With some 600-700K physicians just in the US, a lot of upside community growht for Sermo. BTW, that demo, nothing special but the site does look clean and easy to navigate.

Ben of PLM was next presenting data from the ALS community at PLM looking at efficacy of lithium. Was prompted by a research study in Italy that p[ointed to some possible positive impact. In the past nine months, 300 PLM ALS community members have been using lithium (this is not some sort of formal clinical trial, it’s just happening) and the data is showing no measurable imporvement. Ben went on to say that the US is getting ready to launch mulit-million $$$ clinical trials program to look at lithium for ALS. His argument is that PLM already has the data, now, totally circumventing the clinical trial process. Could this story force us to rethink how some clinical trials should be performed in the future?

MedHelp gave a demo/story of a Victoria Secrets’ bra. Seems that VS introduced a new bra and within a month, MedHelp community members began posting about a rash they were getting from wearing the bra. Problem eventually traced to a new manufacturer in China using material that would cause an allergic reaction for some. Led to VS changing the manufacturing process and sure enough, posts on MedHelp began to subside.

HealthCentral is now up. Gave several demonstrations/page views of different communities at HealthCentral. Nothing terribly new here that I have not seen on any number of health communities. But taking a look at traffic numbers, does appear that HealthCentral is doing ok and is growing in number of uniques. Took a quick drive-by of the site, much different than the other three on the panel, coming across more as a competitor to WebMD or Waterfront Media.

4:30pm Due to low battery have not been able to provide update. But coming back now for wrap-up.

Some quick impressions so far:

- Nothing terribly new being presented. Good event for those new to this market space, but for someone such as myself, well…

- Great networking event. While content of presentations may be thin, the audience is top notch. Lots of great contacts being made.

- One of the big contributors to the size of the event is all the new players. This is becoming a VERY BIG DEAL. Plenty of representatives from the healthcare sector old guard (e.g., payers, pharmaceutical companies and some of the very large providers). Lot of large institutional entities here looking more closely at this market sector.

Has Health 2.0 hit the mainstream?

Sure is beginning to look like it. Then again, we’ll have to see what unfolds over the next 6-12 months as there is a tremendous amount of overlap in solutions being shown here today. Clearly, not all will make it. Actually, most won’t. Challenge for investors is figuring out which one(s) have a truly distinctive product and a good model/strategy to take it to market. Not that much different from any other investment evaluation, with the “minor” exception that one must factor in a financial crisis.

And that financial crisis will put a major crimp in any Health 2.0 company looking to go direct to consumer with a subscription model. This was a challenge before the financial crisis, now it is simply untenable.

Same goes for those looking at an ad-supported model. Online advertising is starting to see some contraction and the healthcare sector will not be immune. And those companies looking to offer their sponsors some type of completely new advertising approach, don’t count on a receptive audience. When the purse strings start to be pulled, new (i.e., risky) ideas are pulled.

Going forward, Health 2.0 companies will need these large institutional entities for sponsorship via adopting their solutions. Therefore, Health 2.0 companies will need to go back to the drawing board and look more closely at the value proposition they can provide these sponsors. As you go back to those drawing boards, think one of two things:

1. How can I save them money?

2. How can I make them money?

Word to the wise: Number 1 is always a much harder sell than number 2.

not a word about dailystrength?

DanD,

I’m focusing the majority of commentary here on companies that I actually hear presenting. Have not seen anything from DailyStrength so far.