Impact on Healthcare IT (HIT) Spending

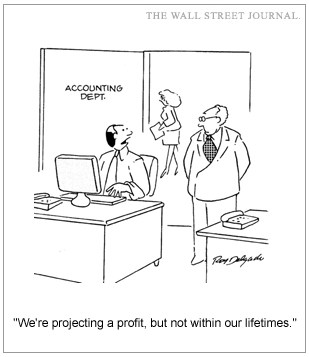

Adding to the tight money situation for businesses of all sizes, regardless of market sector, decreasing consumer spending and the increasing burden of healthcare costs shouldered by consumers will directly impact healthcare. Small to mid-size physician practices will be particularly hard hit as consumers forgo visits. This will, in-turn, slow technology adoption for the foreseeable future and result in drastic consolidation among HIT vendors.

And for those of you holding out for one of the presidential candidates to drop a boat-load of money into HIT, don’t hold your breath. During a debate last week at Harvard, two noted healthcare economists each representing one of the candidates (they were both senior advisors to teh candidates) were quite clear in stating that any promises of large investments in HIT will have to wait while other priorities take precedent.

Despite all the doom and gloom, occasionally one sees a glimmer of brightness. IBM this week pre-announced earnings (to quell market concerns) that were positive. And this morning, I received a similar announcement from WebMD, wherein they state that advertising revenue for the third quarter is up substantially, year over year. Like IBM, clearly WebMD wants to get out in front with positive news to quell investor fears rather than wait till their scheduled 3rd Qtr conference call on Oct. 30th.

Quick Assessment:

- Mid-market HIT vendors targeting physician practices will suffer. Expect consolidation, bankruptcy filings and even shuttered doors. Vendors targeting large practices and hospitals will rely heavily on maintenance and service revenues as customers look to control spend by canceling or delaying large projects.

- There are far to many integration platform vendors targeting the RHIO/HIE market. Most of these will fail. Those that succeed will have a strong, existing client-base (not heavily reliant on RHIOs) with a clear annuity stream to carry them through what will be a tight market for the next 2-4 years. Those with a clear technological advantage will likely be acquired.

- The consumer-facing HIT vendors will have little success going directly to the end consumer. Thus, their go to market strategy must migrate to a B2B2C (business>business>consumer) model. In pursuing such a strategy, they must show clear and demonstrable savings to the business sponsor. Creative financing and cost sharing approaches will increase to fund such deployments.

- Internet-based, consumer-facing health solutions, particularly anyone claiming to be “Health 2.0” company must go beyond the hype and focus on delivering some real value that they can monetize. PatientsLikeMe appears to be on the road to success, far too many others to list do not. A real shake-out will occur here as these start-ups struggle to raise cash.

- Whether one likes it or not, clearly, there is money in advertising but tapping that source will require a company to show that they have the visitors and are growing in number of impressions. That growth should exceed overall growth in health-related search. WebMD is one clear example, Waterfront Media another and eMarketer lists a few more.

Quick Note: Just found this article over on CNET that takes hard look at Web 2.0 companies with the potential to blow-up. Hmmm, if one were to make a similar one for the Health 2.0 apps sector, who would You put on the list?

0 Comments